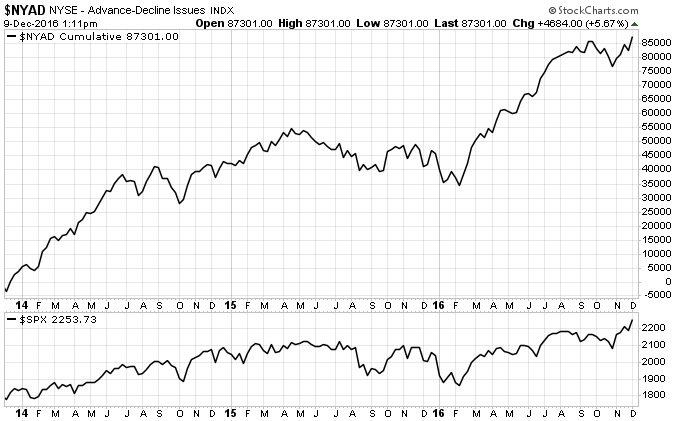

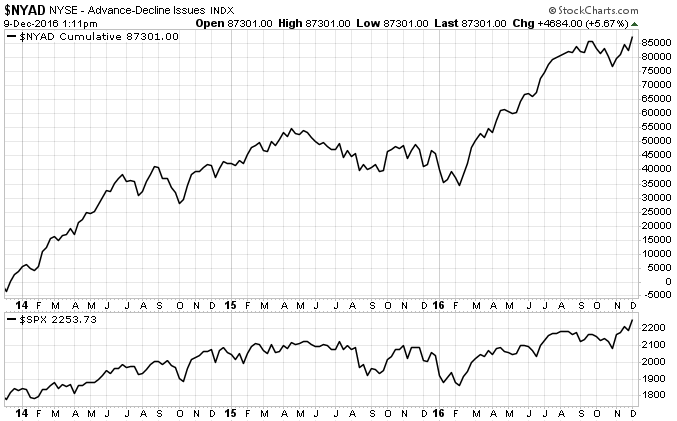

Last week, I mentioned that I’d be watching breadth and measures of market quality closely due to the fact that they were lagging the market. This week, breadth as measured by the NYSE Advance / Decline line (NYAD) has improved and cleared the divergence that had been in place. As mentioned in the post, divergences under 13 weeks are often noise… which ended up being the case this time. NYAD making new highs as the market breaks out is the type of action I like to see.

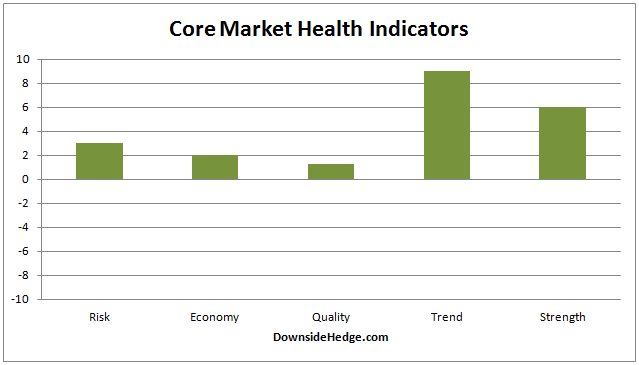

My measures of market quality ticked up slightly this week, but they aren’t showing the strength I’d like to see in the intermediate term. This isn’t too concerning in the overall scheme of things, but the lack of strength could cause them to fall below zero in the next week or two if their intermediate term trend isn’t righted. This would have us raising cash or adding hedges amid a rising market if the price trend continues.

Conclusion

Breadth measures are confirming the move higher in the market, but measures of market quality are still lagging. The overall picture is positive, but market quality needs to move higher quickly or we’ll be forced to soften portfolio allocations.

Leave A Comment