According to a report in the Times newspaper, the British government intends to trigger Article 50 on March 9th. Approving the measure is the official announcement to leave the European Union.

Members of parliament are expected to approve the bill, respecting the will of the people as reflected in the EU Referendum last year. While some rebellions are predicted from Remain supporters in various parties, most of the those who objected the departure will fall in line.

UK PM Theresa May previously committed to triggering the move before the end of March. The decision of the High Court and later the Supreme Court to have parliament approve the event do not seem to delay the move.

GBP/USD and Article 50

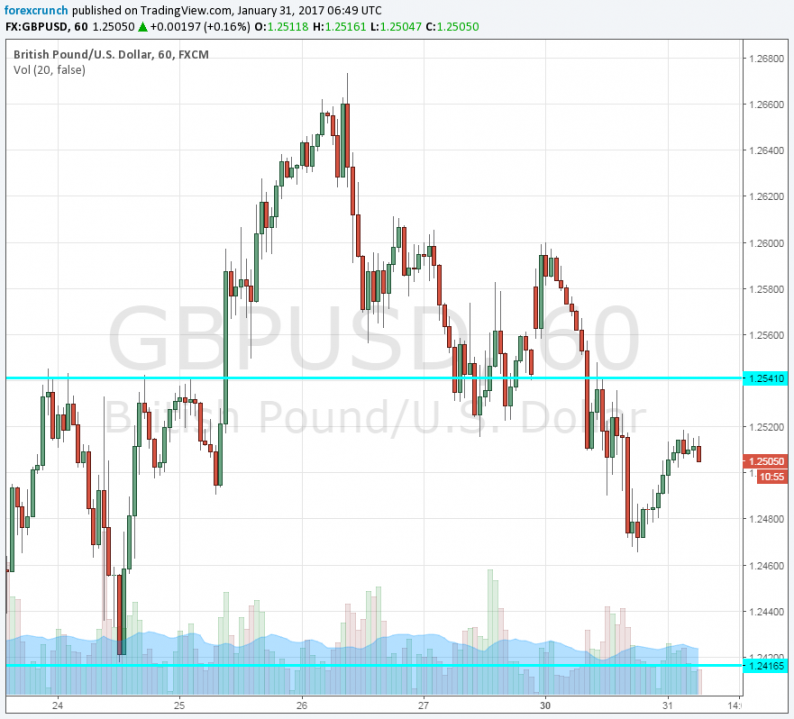

Pound/dollar trades around 1.25. While the Brexit details are certainly of interest to Sterling recently, the bigger mover of cable has been the dollar, and especially due to Trump’s immigration ban. The chaos in airports, courts, and the international criticism has hurt stock markets and triggered safe-haven flows.

Returning to Brexit, it seems slightly earlier than expected, closer to the beginning of the month than the end of the month. We know the result of the Brexit Referendum for already seven months, but the historical, official move and the beginning of formal negotiations could still weigh on sterling.

Will GBP/USD begin falling even before March 9th?

At the moment, the pair is trading just above 1.25. Resistance awaits at 1.2540, albeit it is a weak level. Further resistance is at 1.2660. Support is at 1.2415 and 1.23.

More: GBP/USD: Reverse H&S Target – Citi

Leave A Comment