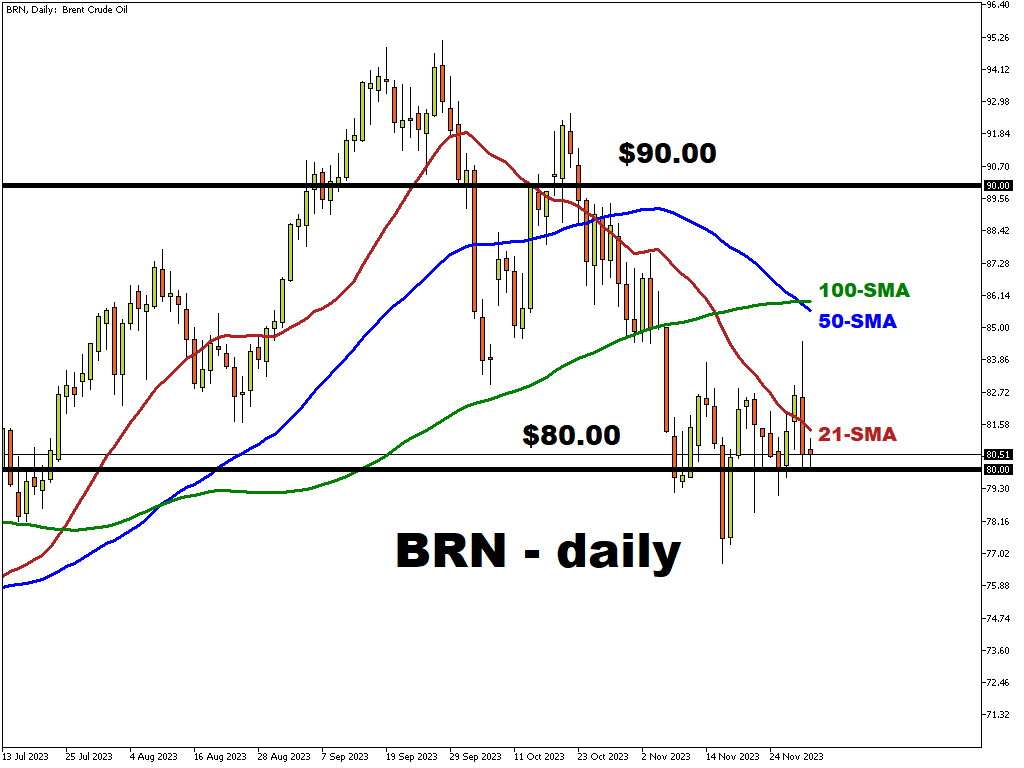

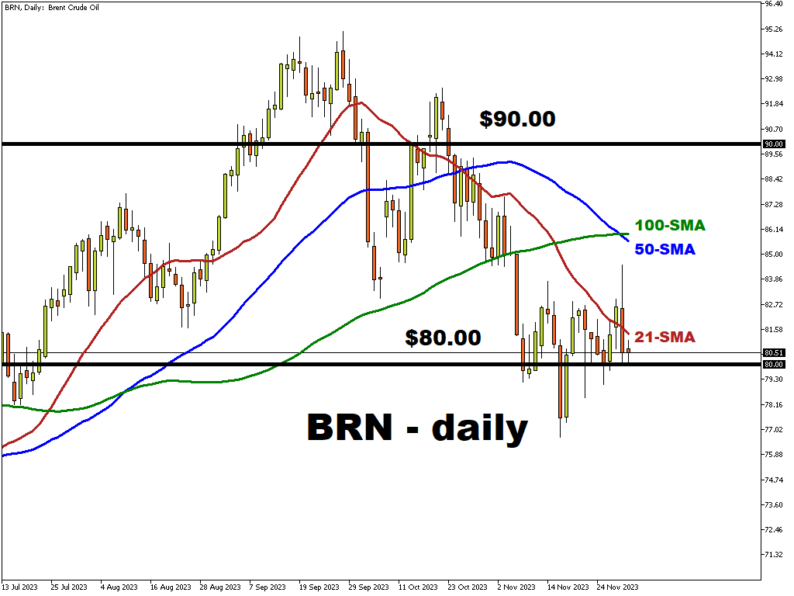

BRN is trying to stabilize above the $80/bbl psychological level following the confusion sparked by the OPEC+ meeting on Wednesday.

Despite the OPEC+ announcement of it’s new 900k bbl/day supply cuts, investors have remained uncertain on whether these reductions will be fully taking place as they are being introduced on a “voluntary” basis.

Previously implemented voluntary cuts (~1.3M bbl/day), by Russia and Saudi Arabia, were also extended into Q1 2024.Adding to the downside:

However, any changes in the 2024 demand outlook or a sudden escalation in the Middle East may significantly affect oil prices.

From the technical perspective…

More By This Author:S&P 500 Stabilizes At ~4558 After A Sharp Rebound

USD Hits Three-Month Lows Ahead Of US CPI

BTC Is Testing 21-SMA Support Level

Leave A Comment