This market has frequently demonstrated a negative correlation with traditional industries.

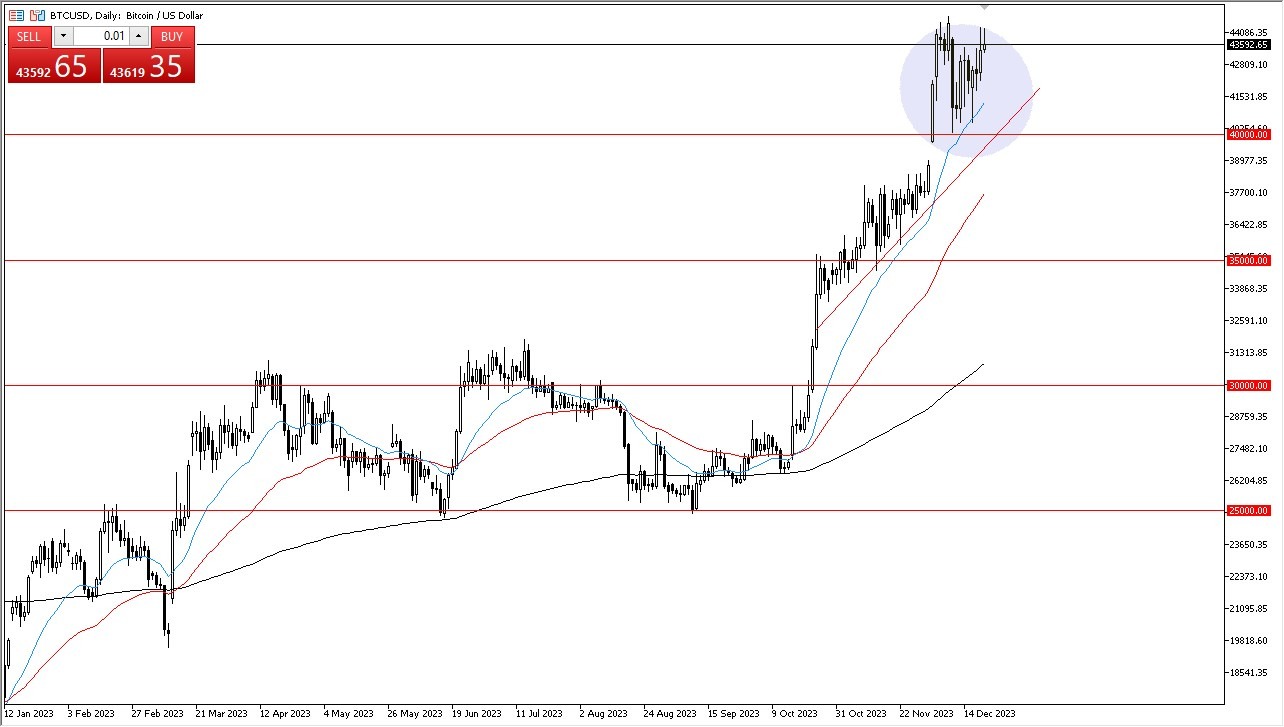

In the event of any pullbacks in the market, they should be regarded as favorable buying opportunities. The market demonstrates evident bullish sentiment, and there are notable support levels to consider. The 20-Day Exponential Moving Average (EMA) provided support earlier in the week, and there’s also the $40,000 level beneath it, which could offer substantial support. Generally, this market seems to possess a robust support base, and as interest rates continue to decline, it becomes increasingly logical for institutional investors to seize opportunities in the form of “cheap coins.”No shortingIt’s crucial to emphasize that I have no inclination to short this market. While liquidity may pose some challenges over the next few trading sessions, the long-term trend appears solidly entrenched in favor of Bitcoin.This market has frequently demonstrated a negative correlation with traditional industries. As these conventional sectors continue to experience declines in the United States, institutional investors are increasingly willing to venture into higher-risk assets, with cryptocurrencies being notably positioned on the risk spectrum. Investing in the crypto market inherently involves embracing substantial risk, and the decline in interest rates further incentivizes investors to explore this arena. Consequently, I anticipate that we will witness sustained upward momentum over the long term.In conclusion, any contemplation of shorting this market would require a substantial breakdown below the 50-Day EMA, a scenario that currently appears remote given the prevailing market dynamics and sentiment. At this point in time, I believe that the market is going to be very positive for the year 2024, and maybe even further as the Federal Reserve continues to loosen monetary policy. That being said, there is a real possibility that we eventually have some kind of “risk off event”, which could be negative for the BITC markets.  More By This Author:AUD/USD Forecast: Sees Upward MovementCrude Oil Forecast: Markets Show HesitationUSD/CHF Forecast: Struggles Against the Swiss Franc

More By This Author:AUD/USD Forecast: Sees Upward MovementCrude Oil Forecast: Markets Show HesitationUSD/CHF Forecast: Struggles Against the Swiss Franc

Leave A Comment