Superior Industries International, Inc. (SUP – Analyst Report) is cashing in on the hot auto market. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by the double digits both this year and in 2016.

Superior is the largest manufacturer of aluminum wheels for passenger cars and light-duty vehicles in North America.

It operates plants in the U.S. and Mexico and supplies aluminum wheels to the original equipment market. Its largest customers include most of the big auto makers such as BMW, FCA, Ford, General Motors, Mazda, Nissan, Subaru, Tesla, Toyota and Volkswagen.

A Solid Third Quarter

On Nov 3, Superior reported its third quarter results and met on the Zacks Consensus Estimate which was calling for 19 cents. It had beaten the prior three quarters so it has either beat or met over the last 4 quarters.

Unit shipments jumped 6% to 2.8 million year over year.

It has closed older manufacturing facilities and opened a new, more efficient factory in Mexico, which is expected to ramp up production in the fourth quarter.

Raised 2015 Value Added Sales

The company adjusted its full year guidance by raising its full year value added sales and lowering its net sales to reflect lower than expected aluminum prices.

The analysts liked what they heard as 2 estimates were raised for both 2015 and 2016 since the earnings report.

2015 earnings are now expected to jump 43.1% compared to a year ago.

But they don’t expect the good times to end this year. 2016 is forecasted to bring another 17.2% earnings growth.

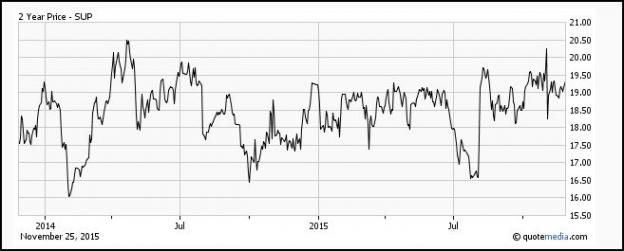

Shares In Narrow Trading Range

Shares have bounced off the recent lows but are still trading in a narrow trading range they’ve been in for the last 2 years.

But they’re not that cheap. They trade with a forward P/E of 20.6.

Yet Superior is still returning value to the shareholders.

It pays a hefty dividend, currently yielding 3.8%.

It’s also repurchasing shares as part of its $30 million buyback program. Year-to-date it has repurchased $16.2 million.

Leave A Comment