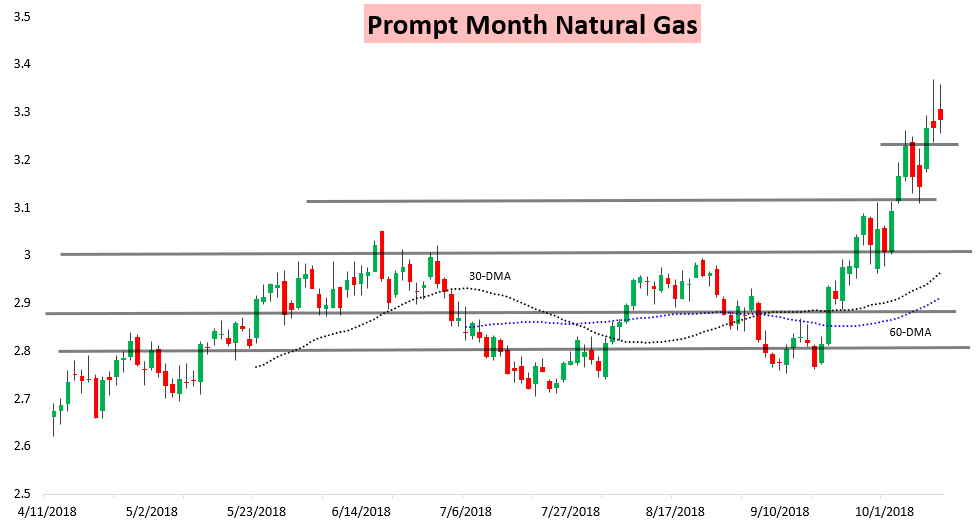

It was another volatile day in the natural gas space, as once again overnight gains in the November natural gas contract were mostly wiped out during the day, with the contract settling up just half a percent.

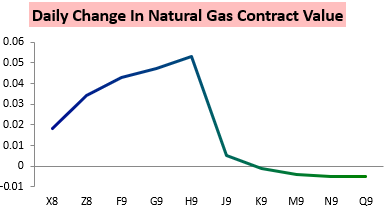

Again today we saw significant differences in contract movement along the natural gas curve too. The March contract actually logged the largest gain on the day.

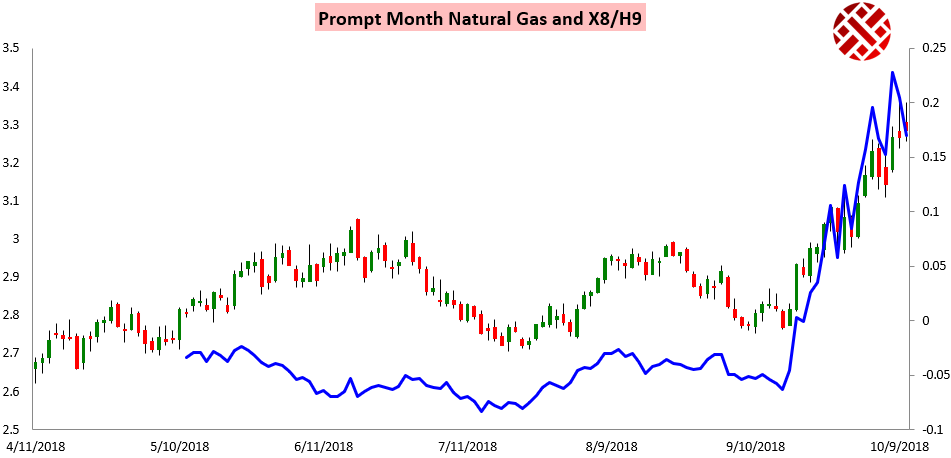

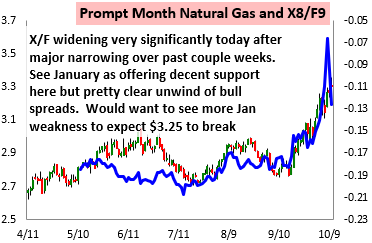

The result was the beginning of an unwind in the recent huge rally we have seen in the X/H November/March spread.

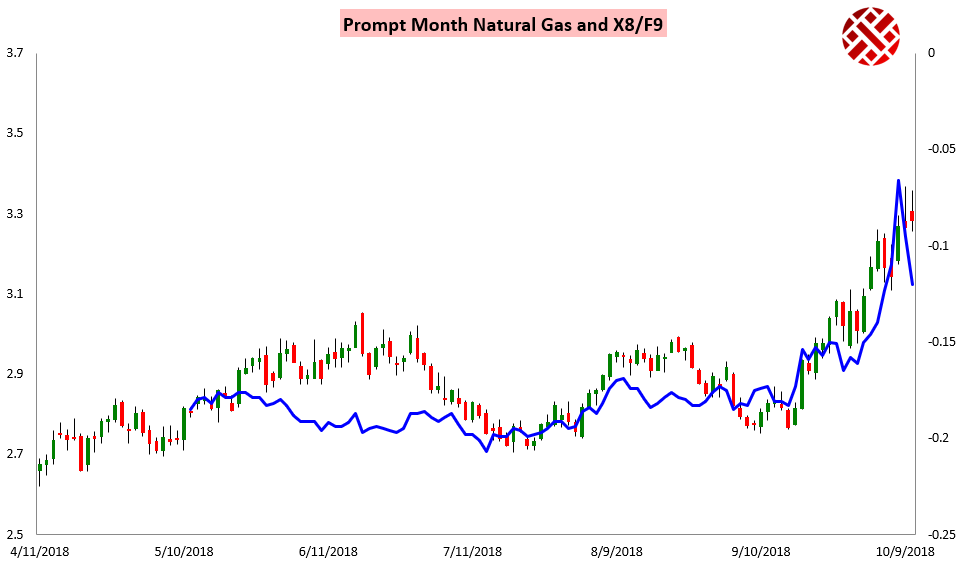

In the last couple days we have seen a more sustained unwind in the November/January X/F spread as well.

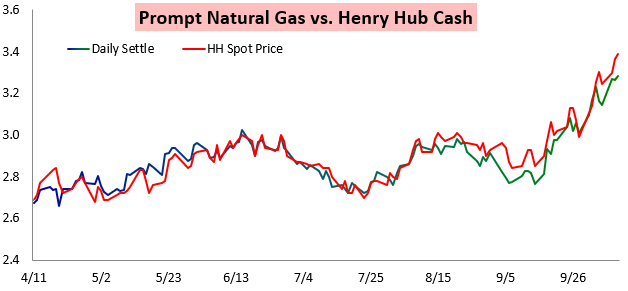

This spread unwind came even as Henry Hub cash prices were relatively firm on the day.

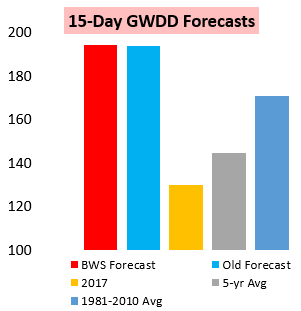

Today’s price action was not particularly surprising for clients, however, as we warned this morning that our natural gas sentiment had turned back to “neutral” despite the overnight rally for a number of reasons, including the inability to further add sizable GWDDs to the forecast.

Today we took a look at the latest weather-adjusted balances and the role of Hurricane Michael in the natural gas market. We also looked at intraday spreads, concluding that January support should protect the $2.75 level for the November contract. Sure enough the contract set a low at $2.751 on the day.

Leave A Comment