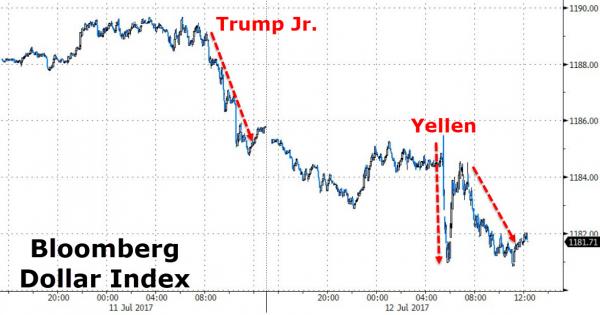

Did The Fed just step in to replace the Trump premium as Junior’s email dashes hopes of tax breaks further? Timing is certainly interesting…

Equities and Treasuries rose and the dollar sank after markets interpreted Chair Yellen’s testimony before Congress as dovish even as it echoed the most recent FOMC statement. The rally was aided as the Fed chair made no mention of asset prices just a week after her comment that some looked “somewhat rich.”

Yesterday’s Trump-Junior-Dump was indeed a ‘storm in a teacup’ as a flip-flopping Yellen showed the way this morning by hinting once again at just how clueless The Fed is and that rates may not raise much from here…

Cash markets show the big gap open then only Nasdaq drifted higher (up 4 days in a row – longest streak since May)…Trannies were best

VIX was clubbed like a baby seal once again

Yellen’s dovish statement sent Bonds, Stocks, and Gold higher…

But from Trump Jr’s emails, Gold is leading…

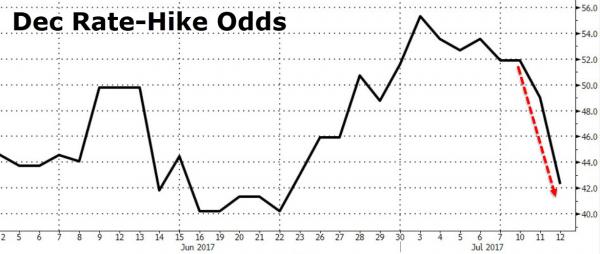

And collapsed December rate-hike odds…

FANG Stocks rose for the 4th day in a row, back to 3-week highs and somewhat crucial resistance…

Notably, while stocks were up on the day, it is intersting that they went NOWHERE (Nasdaq best, Small Caps worst) after the initial opening ramp from Yellen… (performance from 0935ET…)

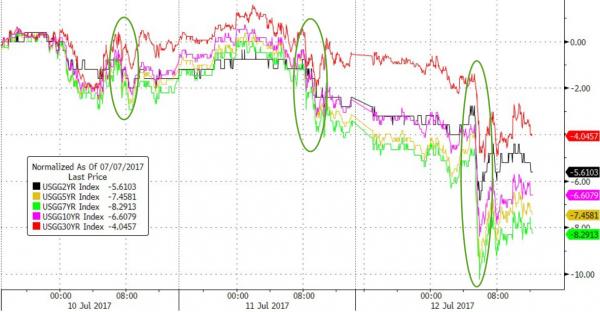

Treasuries rallied on Yellen’s dovish tone – best day in almost a month for bonds… (dropping long-end yields to 4-day lows)… Treasury curve flattened modestly today.

The Dollar Index was smashed lower (extending Trump Jr. drop) on Yellen’s prepared remarks, panic-bid back, and then sunk for the rest of the day…

The Canadian dollar saw broad gains after the BOC surprised most participants with upbeat Monetary Policy Report that dismissed low inflation as transitory and brought forward to 2017 the closing of the economy’s output gap.

Leave A Comment