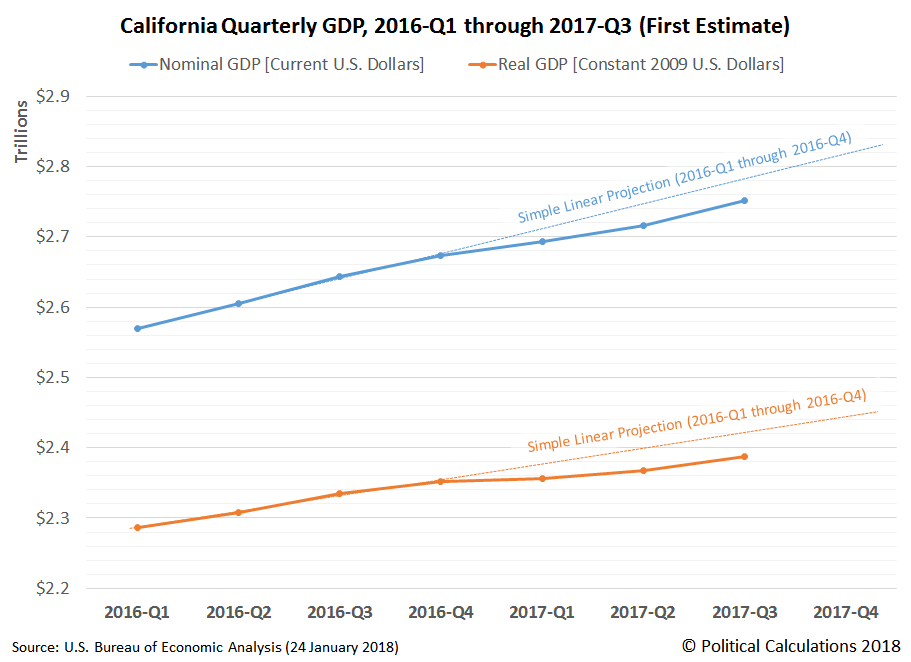

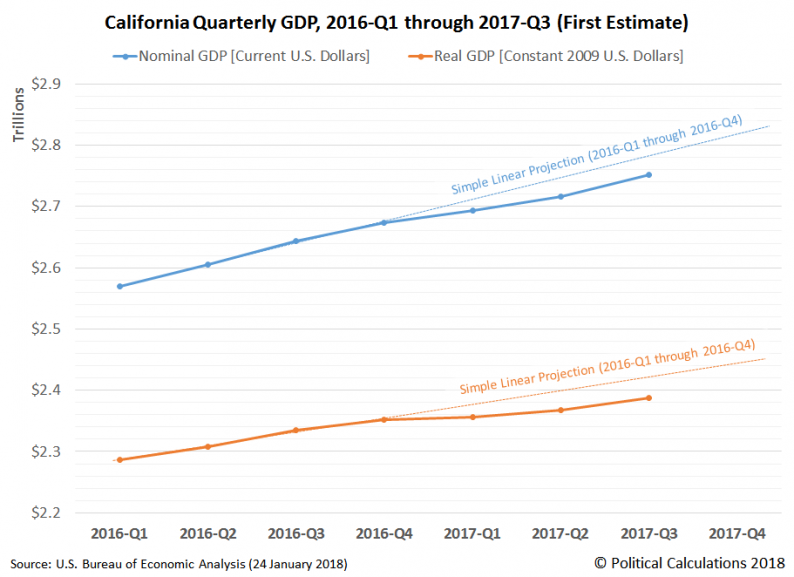

California’s economy took a pretty big hit in 2017. Specifically, it appears to have taken a pretty big hit in the first quarter of the year, after which it appears to have slowly recovered at real growth rates that are slower than what the domestic U.S. economy has seen as a whole. The following chart shows the BEA’s estimated GDP for California in the period from the first quarter of 2016 through the just-released preliminary data for the third quarter of 2017.

In the chart above, we’ve used simple linear projections to illustrate the extent to which California’s nominal and inflation-adjusted gross domestic products in 2017 are falling below their 2016 trends. Although the slowing trend really began in 2016-Q4, as you can see, most of that gap between previous trend and actual performance opened up in 2017-Q1, when California’s economy appears to have stagnated. Since then, the gap has continued to persist through 2017-Q3, even as the state’s economic growth rate has rebounded.

Drilling down into the state level GDP data, we find that the most negatively affected industries in California in 2017-Q1 was its agricultural sector, followed by its finance and insurance industry, neither of which have recovered to the levels they were at the end of 2016. The same holds true to a lesser extent for the state’s mining, construction, manufacturing and utility industries, which have also seen recessionary conditions in 2017. The state’s manufacturing and finance and insurance industries have shown some signs of recovery in 2017-Q3.

Since the BEA’s regional GDP data lags the current day by nearly four months, state officials seeking to respond in a timely manner to unexpected changes in the state’s economy without foolishly waiting months or years for data revisions to be produced as some isolated academics with little-to-no real world leadership experience might desire can use the state’s monthly employment data to get a more real-time picture of the state’s economic situation in order to determine what actions they might need to take to avoid allowing any developing problems to needlessly escalate. The following chart shows California’s trailing twelve month average labor force and employment levels as reported by the state’s Employment Development Department, which shows the trends for both from January 2004 through December 2017.

Leave A Comment