Campbell Soup Company (CPB – Free Report) posted first-quarter fiscal 2018 results, wherein both earnings and sales missed the Zacks Consensus Estimate and declined year over year. This marks the third consecutive quarter of negative earnings surprise with fourth straight revenue miss.

Per management, the underperformance was due to a volatile operating environment along with intense competition and fast evolving retail landscape. These have been pressuring the company’s top line for a while now.

Consequently, shares of the company are down 8.8% in the pre-market trading, owing to dismal first-quarter results and unimpressive outlook for fiscal 2018. Overall, Campbell’s shares have lost 7.5% in the last three months, wider than the industry’s decline of 2.2%.

Q1 Highlights

Adjusted earnings of 92 cents per share dropped 8% year over year and lagged the Zacks Consensus Estimate of 97 cents. Including one-time items, Campbell reported earnings of 91 cents per share that decreased 3% from the year-ago quarter.

Net sales of $2,161 million slipped 1.9% and also missed the Zacks Consensus Estimate of $2,179.6 million, mainly owing to soft organic sales. Organic sales dipped 2% on account of lower volumes, mainly in the Americas Simple Meals and Beverages segment.

Further, the company’s adjusted gross margin contracted 2.1 percentage points to 36.5%. The decline was mainly due to cost inflation, escalated supply chain expenses and adverse mix, somewhat negated by productivity improvements as well as gains from cost savings.

Moreover, adjusted EBIT for the quarter fell 14% to $417 million owing to lower gross margin, soft sales and increased adjusted administrative costs, partly compensated with lower marketing and selling costs.

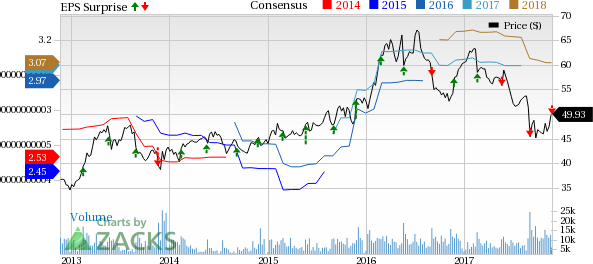

Campbell Soup Company Price, Consensus and EPS Surprise

Campbell Soup Company Price, Consensus and EPS Surprise | Campbell Soup Company Quote

Segment Analysis

Leave A Comment