Photo Credit: Shawe Ewahs

Key Takeaways

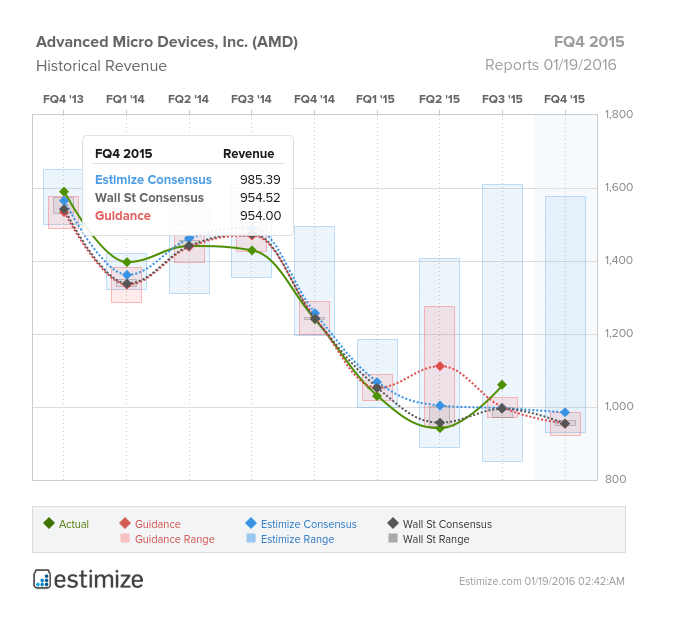

Today, worldwide semiconductor manufacturer, Advanced Micro Devices (AMD) is scheduled to report Q4 2015 earnings, after markets close. These past few years have been particularly tough for semiconductors as the U.S. dollar grows stronger and demand for PCs decline. The industry’s downward trend is expected to carry through 2016, and drag down AMD’s earnings. The global chip maker is poised to miss expectations for the 7th straight quarter as they close out their fiscal 2015. The Estimize community calls for EPS of -$0.10 and revenue of $985.39 billion, slightly higher than the Wall Street consensus. Compared to Q4 2014, this represents a YoY decline in revenue of 18%. AMD’s core business as a CPU and GPU provider continues to relinquish markets shares to industry leaders, Intel (INTC) and NVIDIA (NVDA). Unfortunately without any new innovations and mounting debt and losses, the future of AMD does not look promising.

A number of factors have led to the downward spiral of the global semiconductor company. Over the past few years the PC market has plummeted due to an overall weaker demand for computers. Personal computers have been slowly replaced by Apple products, tablets and smartphones. That being said, a stronger U.S. dollar has also dragged down global PC sales which greatly impact AMD’s top line. In addition to a weak PC market, AMD is slowly being pushed out of their core business. On the CPU front, AMD continues to relinquish market share to Intel, who now controls over 90% of the semiconductor industry. AMD has also had trouble in the GPU market, as its products fail to disrupt the stranglehold NVIDIA has at the moment. With consistent negative revenue and cash flow, AMD has mounted debt obligations exceeding $2 billion. Such a large debt liability not only adversely impacts cash flow but limits AMD’s ability to raise debt to pursue future strategic opportunities. On the bright side, Microsoft’s Xbox and Sony’s Playstation use processors developed by AMD. However these sales are minimal compared to PC related sales and won’t be enough to rescue future misfortunes.

Leave A Comment