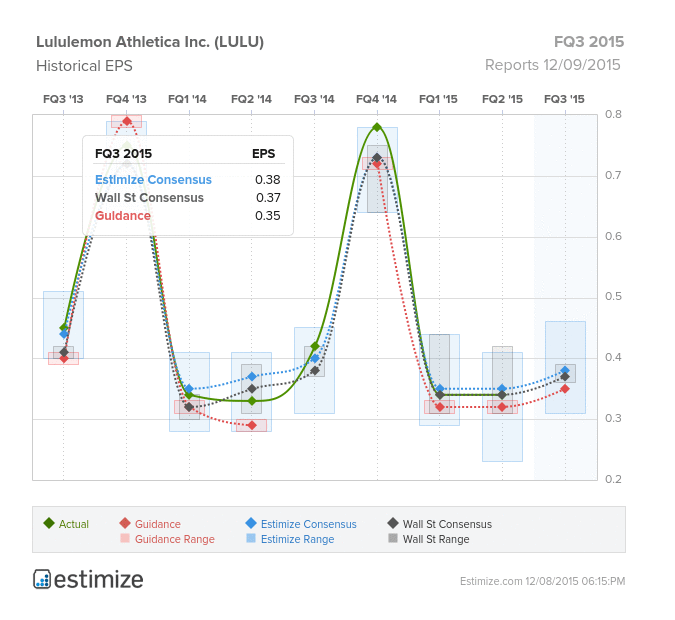

Lululemon Athletica (LULU), the leading high-end yoga inspired clothing retailer, is set to report 3Q2015 earnings early tomorrow morning. Analysts are expecting a year over year decline in EPS but a year over year increase in revenue. Times have been tough for the retailer, as competition has stiffened. The Estimize consensus is forecasting EPS of $0.38 and revenue of $481.4 million while Wall Street analysts are calling for EPS of $0.37 and revenue of $481.6 million. Shares are currently down 25% since early September, but there may be a silver lining for the company as an expansion into Europe and Asia in the next two years is imminent.

Inventory and Sales

Last quarter, Lululemon reported that inventory was up 55% year over year. The company claims that operating expenses, namely additional transport costs, significantly skyrocketed due to the problems at the West Coast ports. Because of late deliveries, the company has had to discount its clothing and accessories significantly to make up for any incurred losses.

However, sales for the quarter are expected to increase by about 15% year over year, as a combination of new store openings, same store sales and online sales are driving growth. Comps are expected to rise 9%, definitely a positive figure for investors to consider.

Clothing Issues and Competition

In 2013, Lululemon’s popular women’s yoga pants were recalled because the fabric was see-through, to the chagrin of customers. Recalls led the company to lose over $65 million in sales. Earlier in 2015, women’s tops with drawstrings were causing facial injuries. The elastic cords on certain jackets and hoodies had the tendency to get caught on other objects, and snap back, potentially causing injury to the face or eyes of the wearer. The company had to recall approximately 300,000 units. Continued hiccups in clothing design could cause LULU’s loyal customers, investors, and analysts to lose faith in the company.

Leave A Comment