Photo Credit: Mike Mozart

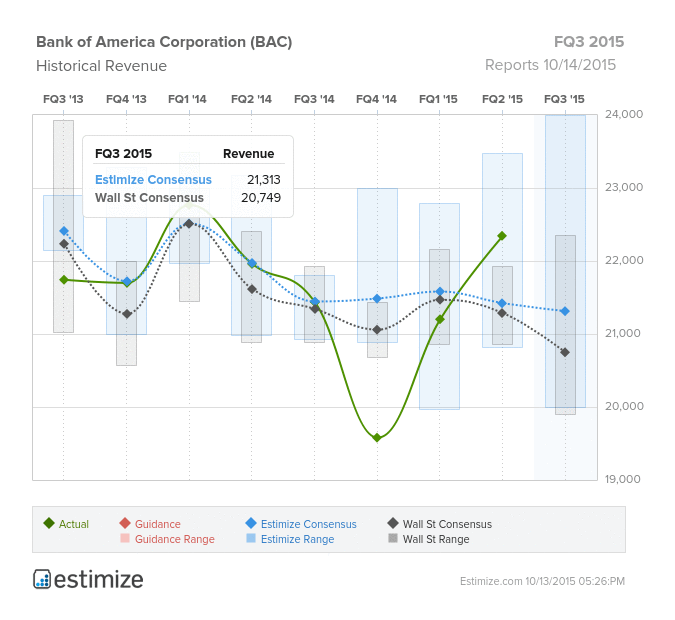

Charlotte, NC based Bank of America (BAC) is set to report earnings before tomorrow’s opening bell. The Estimize consensus is currently looking for EPS of $0.36, a nice improvement from the year-ago loss of $0.01, and revenues of $21.33 billion, a decline of 0.5%. Wall Street analysts are expecting lower earnings and sales of $0.34 and $20.75 billion, respectively.

Earnings season is in full force and this week will be important as almost all of the major banks (except Morgan Stanley) are set to report earnings. Investors and analyst have been watching these large banks in particular to understand the impact of the Fed’s decision to keep interest rates near zero.

Brian Moynihan Stays!

A few weeks ago, Bank of America shareholders voted to let Brian Moynihan retain his position as Chairman and CEO of the company. With Moynihan at the helm, BofA will continue its current cost cutting strategy as long as interest rates stay put and the economy continues to miss growth targets. As a result, operating expenses may be down.

Additionally, Moynihan has stated that the company may experience a decline in trading revenues of 5-6%. This would be reflective of dips in fixed income and commodities trading. But, increases in equities trading may help absorb the declines a little bit. Trading revenues last quarter were down 2%.

Lower legal expenses – Finally

Since 2008, BofA has dished out over $60 billion in legal fees and settlements. The bank was able to reduce legal fees last quarter to $2.24 billion from $2.5 billion. One positive is that as of now, no litigation issues are in sight.

Tech Praise

Normally, large banks aren’t known for their innovations in technology. Bank of America has been working at this for quite some time via ownership of patents. In recent years, BofA has consistently ranked in the US Patent Office’s list of top 300 patent receivers.

Cathy Bessant, the bank’s chief operations and technology officer, has stated that intellectual property protection has significantly increased in efforts to show the world that Bank of America is indeed a technologically driven firm. It will be interesting going forward to see how Bessant plans to overtake other firms in information technology development.

Leave A Comment