Photo Credit: Tomas Del Coro

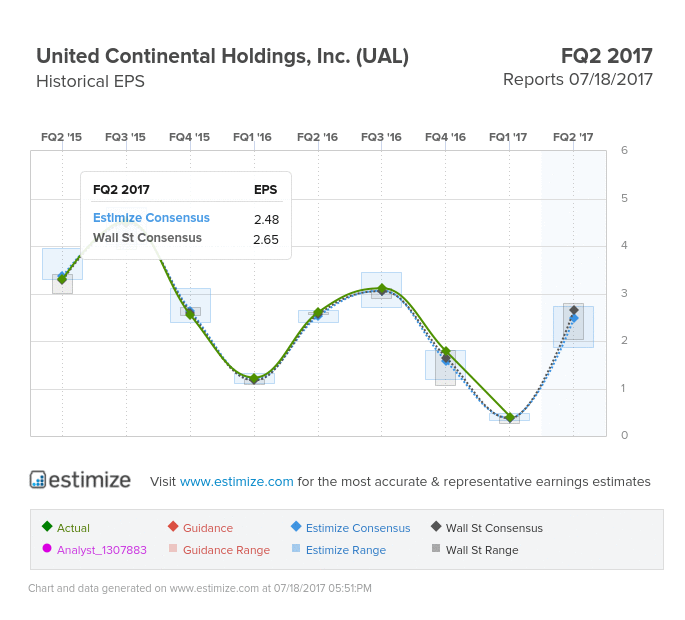

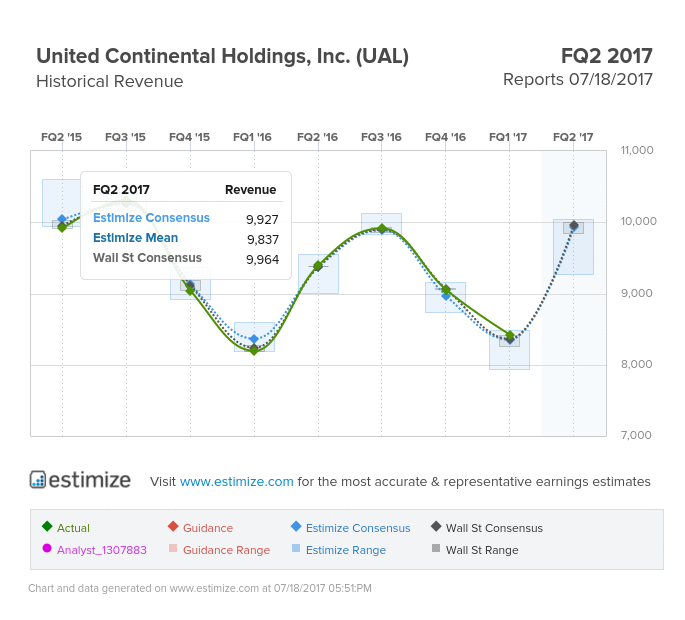

Estimize and Wall Street have differing numbers for UAL’s EPS. Estimize predicts $2.39 and the Street is at $2.47. For revenues the Estimize community is calling for $9.902B while Wall Street is at $9.937B. UAL has beaten the Estimize EPS consensus 80% of the time and the Street 61% of the time. Similarly, UAL has beaten Estimize on revenue 60% of the time and the Street 53% of the time. These are positive numbers heading into this upcoming quarter. However, if investors are looking for a stock whose EPS is projected to grow significantly over time, they may want to be rethink this one. Estimize predicts UAL’s YoY growth to be -5% for EPS, yet 6% on revenue.

UAL’s subsidiaries include United Airlines, United Express, and United Cruises, to name a few. Analysts say that despite last quarter being a bit of a disappointment for airline investors, things are looking up this quarter. That being said, both United (UAL) and American Airlines (AAL) remain less profitable than Delta. Non-fuel costs rose about 3% YoY this past quarter, which looks good for the airline as they originally banked on a 5% increase. This can be attributed to strong operational performance and increased per passenger revenue. Similar to other airlines, the falling fuel prices this past year have benefitted United and allowed them to go from spending roughly $1.77 per gallon to $1.63. However, a supply-demand imbalance, specifically in China and Hong Kong, affected their trans-atlantic market and resulted in United not being able to outperform in revenue.

Despite United potentially not being as profitable as Delta, this could be a good time for investors to jump into the airline industry on the dip. Safe travels and happy investing.

Leave A Comment