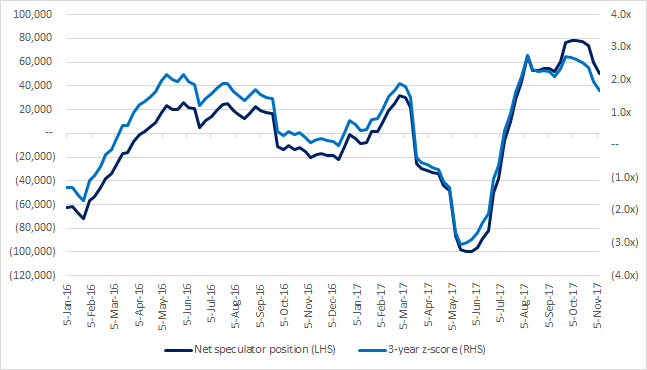

Looking at the latest COT report, extremes this week include crude oil and a new bearish extreme in the Swiss Franc. While long Canadian dollars looked like an extreme position last week, this is no longer the case today. This is shown below:

CFTC COT (futures & options combined) – November 7, 2017

Source: CFTC, MarketsNow

Notable extremes are bolded and are highlighted when speculator positioning is more than two standard deviations above historical trailing 1-year and 3-year trends. Looking at this week’s numbers, a few themes emerge from the data.

Firstly, speculators continue to short currencies that are likely to weaken if inflation strengthens further. Thus short positions are building in both the Japanese yen and the Swiss Franc. Secondly, long crude oil remains a consensus favorite, and speculators have added 39,000 contracts to their net long position this week. Lastly, speculators have been dumping commodity currencies such as the Australian dollar and the Canadian dollar. Despite optimism for crude oil, the same optimism doesn’t seem to be spilling over to the Canadian dollar today.

As rate hike hopes and growth fade into memory, speculators lose interest in Canada

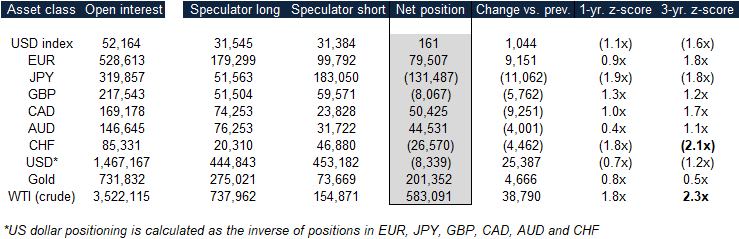

Looking at the recent past, speculators were most bullish on the Canadian dollar just as the currency hit multi-year highs in September. At the time, we warned that the large long position in the currency meant that it was ripe for a reversal. Following our warning, the currency weakened significantly until late October, although it has recently gained some support from stronger crude oil prices. A visual overview of speculator positioning is shown below for reference:

Source: CFTC, MarketsNow

Buy at the top and sell at the bottom?

As shown above, CAD speculators were most net short the currency in early May, just as USD/CAD rose above 1.35. At the time, 3-year z-scores were three standard deviations below historical averages. As the Canadian dollar strengthened over the summer, speculators flipped from being net short to net long. Positions then hit another extreme in September, as USD/CAD approached 1.20. Following our warning at the time, the currency is now trading within a normal range.

Leave A Comment