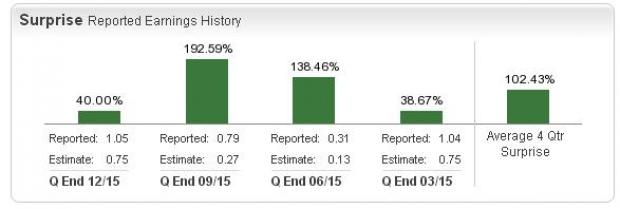

Ontario, Canada-based Canadian Solar Inc. (CSIQ – Analyst Report) will release first-quarter 2016 financial results before the opening bell on May 11. Last quarter, the company posted a positive earnings surprise of 40.00%.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Canadian Solar is likely to beat earnings because it has the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) to be able to beat estimates, and Canadian Solar has the right mix.

Zacks ESP: The Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +146.15%. This is because the Most Accurate estimate stands at 32 cents, much higher than the Zacks Consensus Estimate of 13 cents. This is a meaningful indicator of a likely positive earnings surprise for the company.

Zacks Rank: Canadian Solar has a Zacks Rank #3, which when combined with the company’s positive ESP, makes us reasonably confident of an earnings beat this season.

Conversely, Sell-rated stocks (Zacks Rank #4 or #5) should never be considered going into an earnings announcement, especially when the company is witnessing negative estimate revisions.

What is Driving the Better-than-Expected Earnings?

During its fourth-quarter earnings call, Canadian Solar provided an outlook for the first quarter of 2016. It expects shipments in the range of 1,085 megawatts (“MW”) to 1,135 MW. Total revenue is anticipated to be $645 million to $695 million, with gross margin of 12–14%.

Leave A Comment