There is a strong argument to be made that central banks underestimated the efficiency of the transmission channel between accommodative policies and financial markets while simultaneously overestimating the efficiency of the transmission channel between those same financial markets and the real economy.

That’s from a piece we did for DealBreaker a couple of months back and the point there is that the policy response to the crisis has effectively served to exacerbate the wealth divide in America.

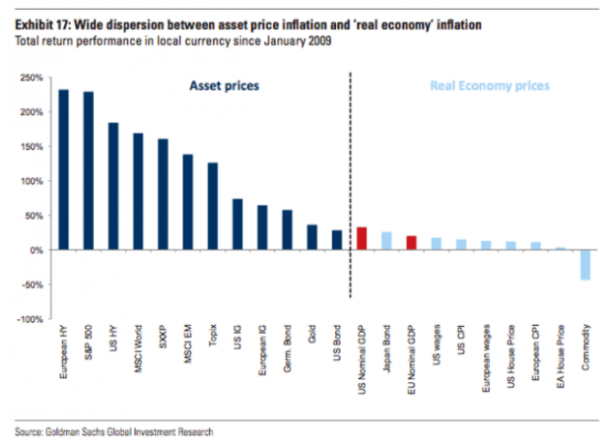

Although this isn’t a perfect way to visualize the excerpted passage above, it does a decent job of getting the point across:

Obviously, central banks were acutely aware that flooding the market with $15 trillion in liquidity would inflate the value of financial assets. The assumption – or so it seems – was that the fabled “wealth effect” would reflate the real economy in relatively short order, and thus the benefits of ultra-accommodative policies would quickly “trickle down”.

Of course, that’s not what happened.

Instead, corporations took advantage of the hunt for yield fostered by ZIRP, NIRP, and QE by implementing debt-funded buybacks, the effect of which was to turbocharge the equity market rally.

Well, guess what? This:

And also this:

Because financial assets including and especially equities are overwhelmingly concentrated in the hands of the rich, the longer policies that inflate those assets take to trickle down, the wider the wealth divide gets.

Relatedly – and this is important – the longer the trickle-down lag, the longer the policies stay in place because after all, those policies were ostensibly designed to reflate the real economy and once you’re pot-committed (which central banks were a long time ago), you can’t very well throw in the towel and say the effort has been a failure. Rather, you’ve got to keep accommodative policies in place until growth and inflation finally tick up. Again, the longer those policies are in place, the wider becomes the divide between those who are disproportionately benefiting from financial asset price inflation and those who aren’t.

Leave A Comment