Cardinal Health, Inc. (CAH – Free Report) reported first-quarter fiscal 2017 adjusted earnings of $1.24 per share, which beat the Zacks Consensus Estimate of $1.21 but decreased 10% on a year-over-year basis.

The earnings beat was driven by 14% growth in revenues, which totaled $32.0 billion and surpassed the Zacks Consensus Estimate of $31.2 billion. The revenue growth was on account of strong performance by both the Pharmaceutical and Medical segments.

FindTheCompany | Graphiq

Quarter Details

Pharmaceutical revenues increased 14% to $28.8 billion owing to strong growth from existing and net new distribution customers. Strong performance from the Specialty business also drove results.

Medical segment revenues increased 12% to $3.3 billion. Higher contributions from acquisitions and net new and existing customers were primarily behind the growth in Medical segment revenues.

Distribution, selling, general and administrative (SG&A) expenses increased 9% on a year-over-year basis to $920 million in the reported quarter.

Pharmaceutical segment profit in the quarter decreased 19% to $534 million due to generic pharmaceutical pricing and reduced levels of branded inflation. This was partially offset by solid performance by Red Oak Sourcing.

Medical segment profit soared 26% to $127 million on the back of strong contribution from acquisitions and the Cardinal Health Brand products.

In the reported quarter, net income declined 19% to $309 million from last fiscal year’s $383 million. Adjusted net income was $399 million compared with $458 million in the year-ago period.

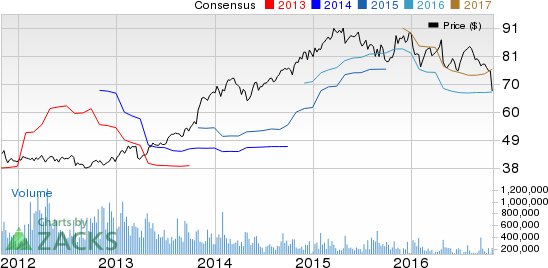

CARDINAL HEALTH Price, Consensus and EPS Surprise

CARDINAL HEALTH Price, Consensus and EPS Surprise | CARDINAL HEALTH Quote

Guidance

Based on fiscal first-quarter results and second-quarter expectations, the company lowered its fiscal 2017 guidance range for adjusted earnings per share from continuing operations to $5.40 to $5.60 from $5.48 to $5.73. The outlook represents growth of approximately 3% to 7% from the prior fiscal year.

Full-fiscal Pharmaceutical segment profit is now expected to be lower than fiscal 2016. The downside would come from generic pharmaceutical pricing and, to a lesser extent, from reduced levels of branded inflation.

Zacks Rank & Stocks to Consider

Currently, Cardinal Health carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader medical sector are Intuitive Surgical Inc. (ISRG – Free Report) , AngioDynamics Inc. (ANGO – Free Report) and Glaukos Corporation (GKOS – Free Report) . Notably, AngioDynamics and Intuitive Surgical carry a Zacks Rank #2 (Buy) while Glaukos sports a Zacks Rank #1 (Strong Buy).

Leave A Comment