Shares of Caterpillar (CAT) have been an underperformer for most of 2018 due to slower sales growth outside of the United States. In recent weeks, this has not been the case. We have witnessed a big rotation into CAT as well as other Industrials as investors are looking to jump on laggards eyeing a rally.

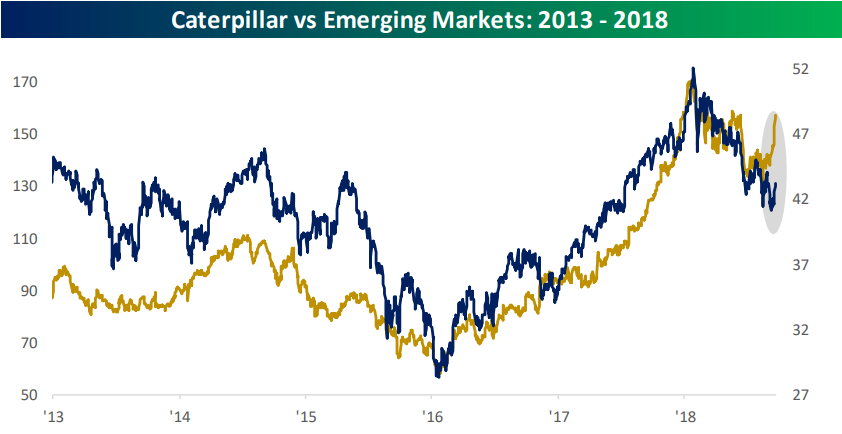

CAT has resembled the performance of emerging markets over the past five years.Logically, this should not come as any surprise seeing as most emerging markets are reliant on natural resources, which is just the right market for CAT’s earth moving equipment. But in recent weeks, we have seen CAT far outpacing the MSCI Emerging Market ETF.

Again, CAT is not the only one of the Industrials that investors have rotated into in September. The sector as a whole has been stronger of late. Today, the sector just went 15 trading days closing at a level higher than it opened. Back to when our data begins in 2002, that streak is by far the longest. April 2004, September 2009, and January 2018 were the only ones that come close — each at 9 days. In each of these periods, in the month following the last day of each streak, the Industrials sector was down for an average decline of 2.5%.

Leave A Comment