Providing components to consumer goods manufacturers in a growing market can be highly profitable. However, this tech firm has been unable to capitalize on impressive growth in its end markets. Now, its falling profits, below average margins, and overvalued stock price earn it a spot in January’s Most Dangerous Stocks Model Portfolio and make Knowles Corporation (KN: $17/share) a Danger Zone pick.

Falling Revenue Leads to Falling Profits

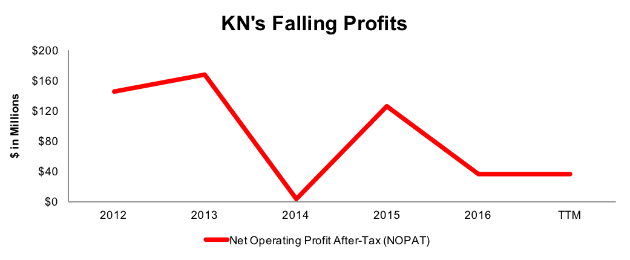

Since 2012, KN’s revenue has fallen 6% compounded annually to $859 million in 2016, and further, to $846 million over the last twelve months (TTM). At the same time, KN’s after-tax profit (NOPAT) has fallen 29% compounded annually to $36 million in 2016 and over the last twelve months (TTM), per Figure 1. The rapid deterioration in profits comes from declining margins. The company’s NOPAT margin fell from 14% in 2013 to 4% TTM. Declining margins and inefficient capital use have knocked KN’s return on invested capital (ROIC) down from 9% in 2013 to a bottom-quintile 2% TTM.

Figure 1: KN’s NOPAT Since 2012

Sources: New Constructs, LLC and company filings

Compensation Plan Allows Execs to Get Paid While Destroying Shareholder Value

Knowles Corporation’s executive compensation plan fails to properly align executives’ interests with shareholders’ interests. The misalignment helps drives the profit decline shown in Figure 1 and enables executives to earn large bonuses while shareholder value is destroyed. Executives’ annual bonuses are tied to many metrics, including revenue, adjusted EBIT, and individual objectives. Adjusted EBIT fails to include items such as stock-based compensation expense and restructuring charges. The individual objectives are filled with vague metrics including “corporate development”, “value creation”, or “supporting corporate development initiatives”.

Beginning in 2017, KN added performance share units to long-term incentive compensation, which previously consisted of stock options and restricted stock units. The performance shares are awarded based on three-year revenue and stock price multiplier goals.

The common thread between all these metrics is that executives are incentivized to meet goals that have little to do with creating true shareholder value. Since 2013, KN’s economic earnings, the true cash flows of the business, have fallen from $4 million to -$121 million TTM.

We’ve demonstrated through numerous case studies that ROIC, not revenue, EBIT, or individual objectives, is the primary driver of shareholder value creation. A recent white paper published by Ernst & Young also validates the importance of ROIC (see here: Getting ROIC Right) and the superiority of our data analytics. Without major changes to this compensation plan (e.g. emphasizing ROIC), investors should expect further value destruction.

Non-GAAP Metrics Hide Losses

Knowles is another on the long list of firms that use non-GAAP metrics, such as non-GAAP gross profit, non-GAAP operating income, and non-GAAP net earnings to present “profit” metrics that mask the true economics of the business. Our research digs deeper so our clients see through these misleading financial metrics. Below are some of the items Knowles removes for its non-GAAP net earnings:

These adjustments have a large impact on the disparity between GAAP net income, non-GAAP net earnings, and economic earnings. Over the TTM period and in 2016, KN removed $24 million (over 11 times TTM GAAP net income) and $22 million (compared to -$42 million 2016 GAAP net income), respectively, in stock-based compensation expense to calculate non-GAAP net earnings. Combined with other adjustments, KN reported TTM non-GAAP net earnings of $82 million. Per Figure 2, GAAP earnings were $2 million and economic earnings were -$121 million TTM.

Figure 2: KN’s Non-GAAP Metrics Hide Declining Economic Earnings

Sources: New Constructs, LLC and company filings

Falling Margins are Troublesome in a Competitive Industry

Knowles produces audio processing devices, micro-electro-mechanical systems (MEMS) microphones, and specialty audio components. It sells its products to mobile consumer electronics manufacturers and the medical, aerospace, and industrial markets. Despite being a leader in the MEMS microphone and hearing aid markets, KN does not achieve the high margins and the competitive advantages one would expect. The industry consists of a few large players, each fighting for a piece of the global smartphone market. Competitors include AAC Technologies, Goertek, InvenSense, Cirrus Logic (CRUS) and ST Microelectronics (STM), among others.

Leave A Comment