In all cases — The Fed, the Bank of Canada, the BofE, the BOJ, and the Bank of Australia — central bankers said they expected to raise rates more in the near future. Even at the Bank of Japan, which has been especially dovish and pro-QE in recent years, the bank scaled back QE a tiny bit:

After years of blistering asset purchases, the Bank of Japan disclosed today that total assets on its balance sheet actually inched down by ¥444 billion ($3.9 billion) from the end of November to ¥521.416 trillion on December 31. While small, it was the first month-end to month-end decline since the Abenomics-designed “QQE” kicked off in late 2012.

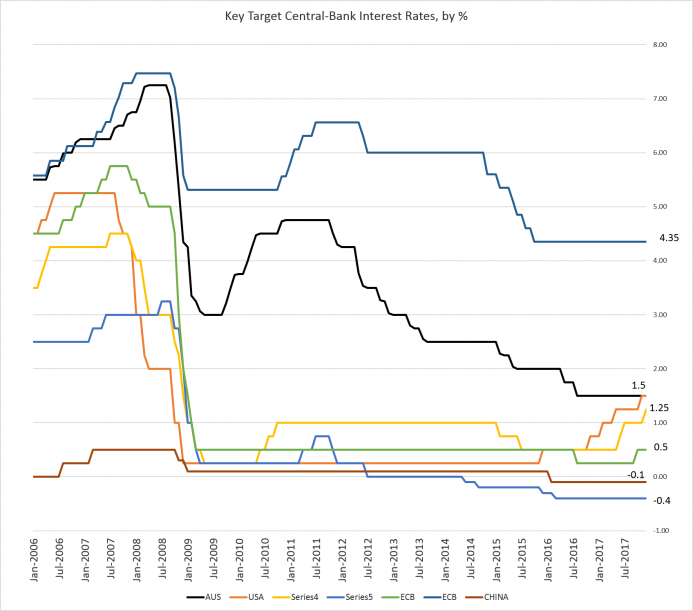

The Bank of Canada has perhaps been the most aggressive at raising rates, with three rate hikes since July.

But, in all cases, rates remain well below where they were in 2008 before the financial crisis. We’re now entering the tenth year of low-low interest-rate policy and Quantitative Easing. And even though we’re hearing constantly about how the global economy is red hot, it appears the most central banks are still reluctant to get anywhere near what might be properly called “normalization.”

One big exception to the claims of more rate hikes is the European Central Bank which isn’t even talking about optimism at this point. Unlike other central banks, the ECB is already saying it might have to miss its self-imposed deadlines for unwinding QE:

Leave A Comment