In today’s era of historically low interest rates, telecom service providers such as AT&T (T) and Verizon (VZ) are often viewed as some of the best high dividend stocks for income thanks to their highly stable, recession-resistant, and subscriber-based business models.

While that may be a good strategy for blue chip names in the industry, it typically doesn’t work nearly as well for smaller, distressed regional telecom players like CenturyLink (CTL).

Let’s take a look at CenturyLink’s 11.5% yield to see if it is too good to be true or if the company’s $34 billion acquisition of Level 3 Communications (expected to close very soon) could make the dividend sustainable.

Business Overview

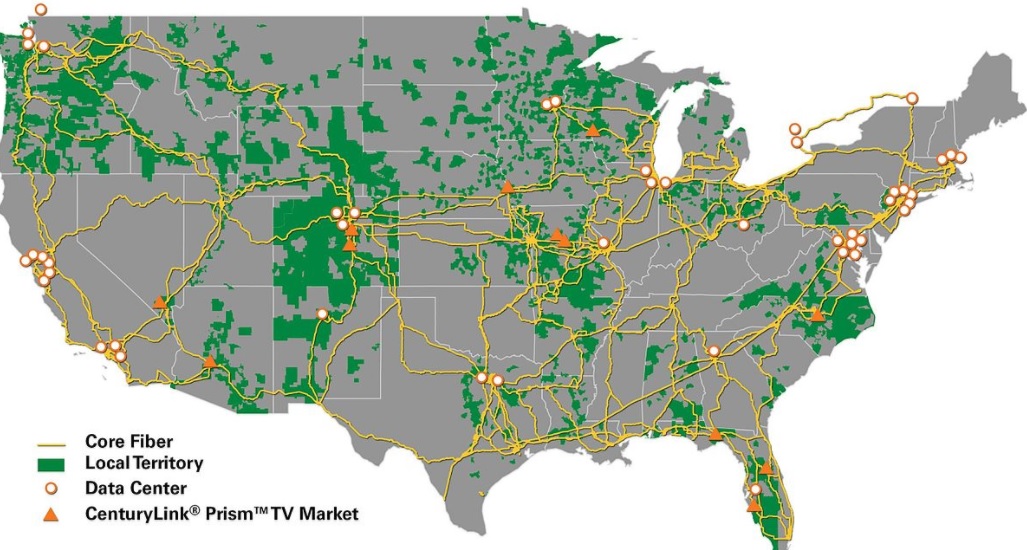

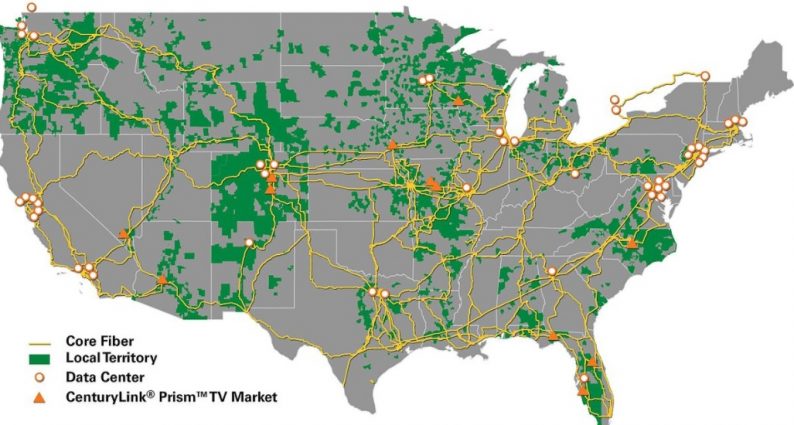

Founded in 1968 in Monroe, Louisiana, CenturyLink started off as a regional telecom company. Thanks to a series of large acquisitions over the years, CenturyLink is now America’s third largest telecom services provider with a total of 11.1 million customer connections in 37 U.S. states.

At the end of 2016, CenturyLink had:

Source: CenturyLink Investor Presentation

It operates through three major business units:

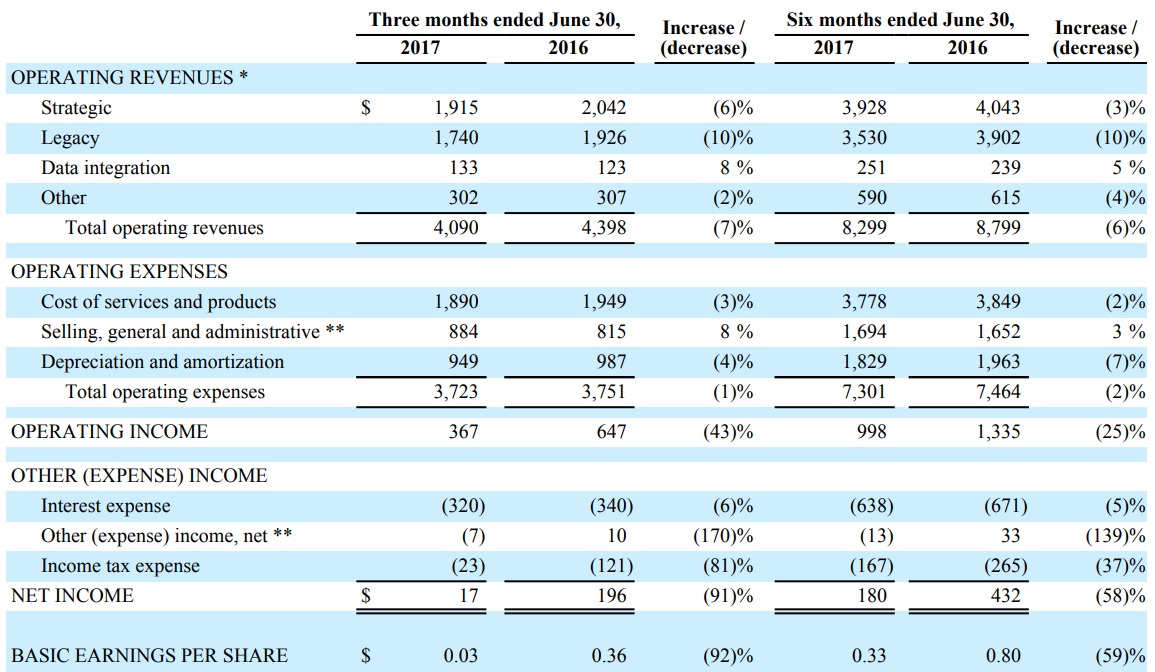

Strategic Services (47.3% of first half 2017 revenue): broadband internet and pay TV

Legacy Services: (42.5% of first half revenue): landline phone service

Data integration (3.0% of first half 2017 revenue): data centers

Note that CenturyLink signed agreements to sell its data centers to BC Partners and Medina Capital in November of 2016, meaning that this small portion of the business (about $500 million annualized revenue in 2017) will soon be gone.

Business Analysis

Like many telecom companies, CenturyLink suffers from two main factors that make it a questionable dividend growth stock.

First, the U.S. telecom market is highly saturated, meaning that profitable organic growth is often hard to come by since breaking into new markets (and stealing share from rivals) is very difficult given the oligopolistic nature of the industry.

More specifically, the majority of market share is typically held by just a handful of incumbents who maintain massive subscriber bases. They can afford to spend more on their networks, invest heavily in marketing, and offer their customers very competitive costs to protect their share.

Since the total number of subscribers isn’t growing much in most telecom industries and there isn’t much differentiation between services provided, telecom operators with less scale typically struggle to lure customers away from their larger rivals.

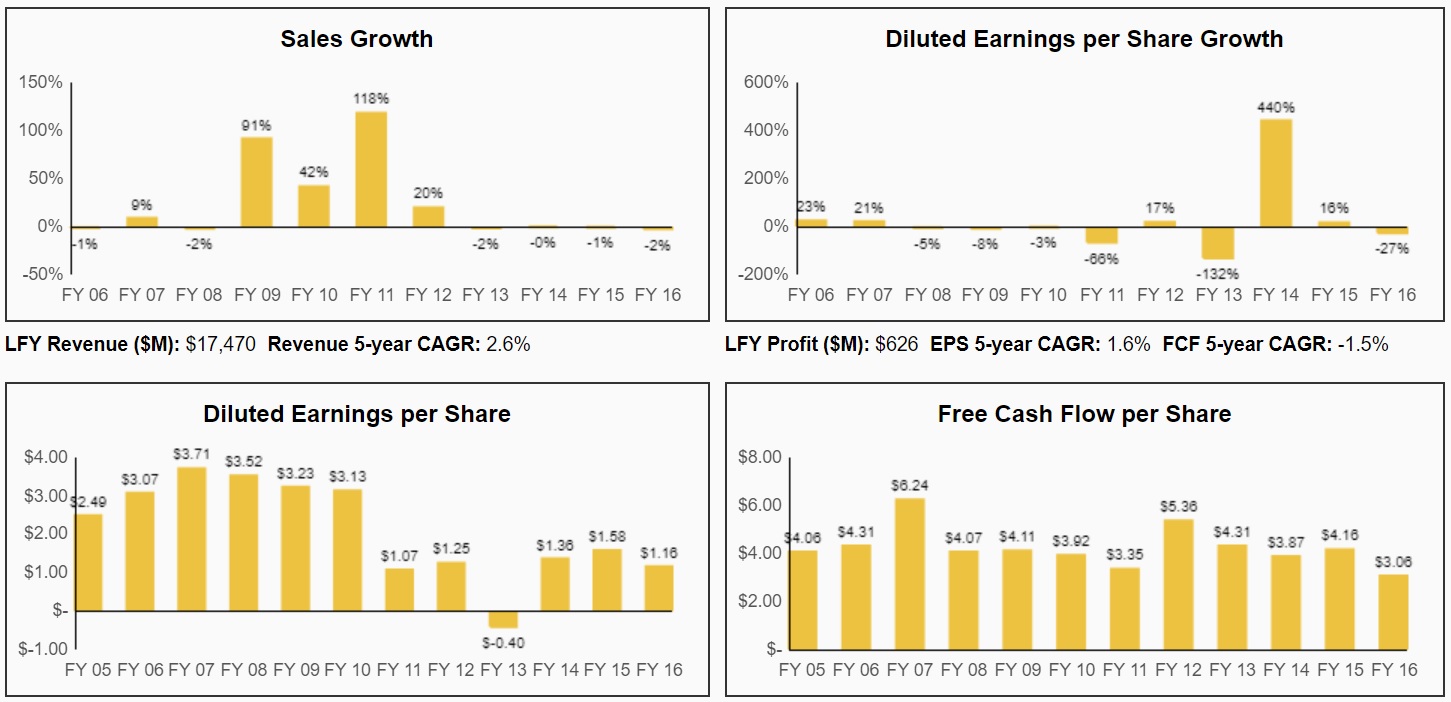

This means that the only meaningful growth most telecoms can achieve is through mergers and acquisitions, a strategy CenturyLink has pursued very aggressively over the years:

You can see that acquisitions boosted CenturyLink’s sales and earnings in the years they occurred, but the business has otherwise been challenged to grow its top and bottom lines.

Source: Simply Safe Dividends

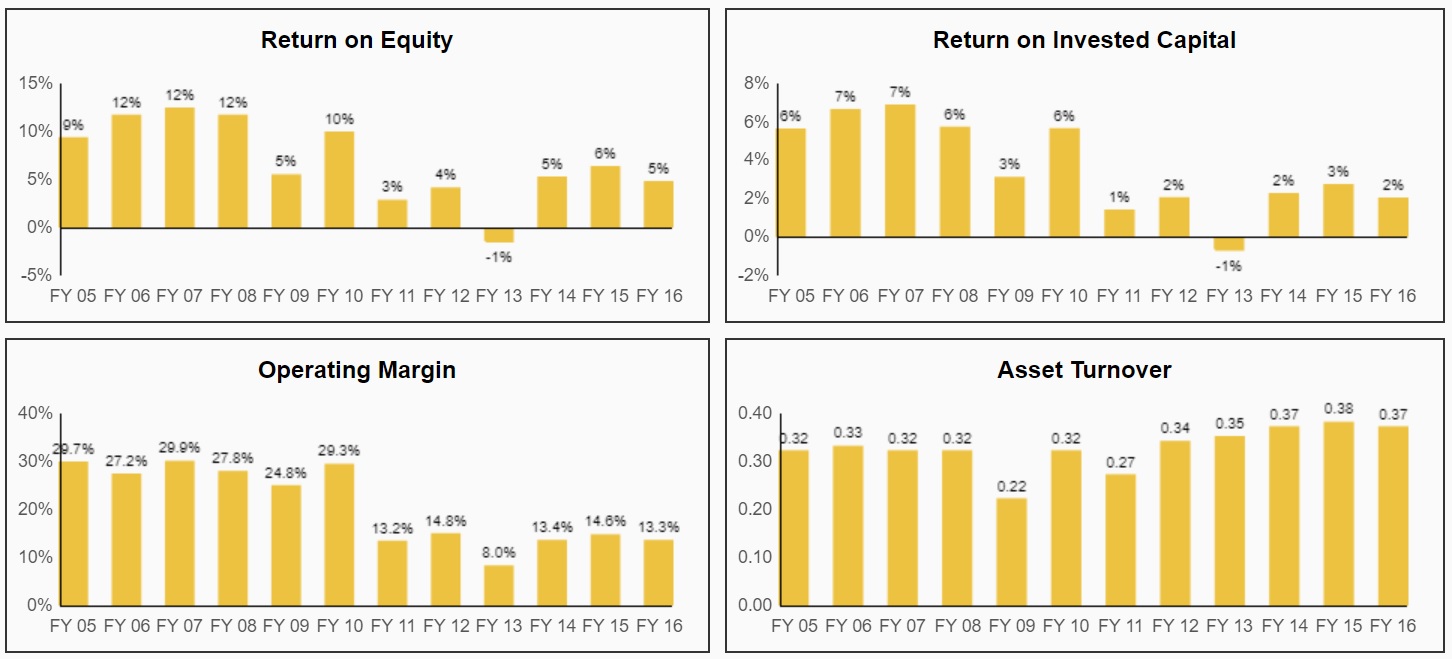

Another major issue CenturyLink faces is the highly capital intensive nature of the business, specifically maintaining, growing, and upgrading fiber optic internet lines, as well as its legacy copper landlines. In fact, over the past 12 months CenturyLink has spent $3.3 billion on capital expenditures, or about 20% of revenue (most corporations spend less than 5% of revenue on capital expenditures).

This is because only 35% of CenturyLink’s internet is 40 Mbps or faster, the minimum speed required for streaming high-quality video on demand, which is a major trend that is expected to continue.

This high amount of fixed costs, combined with a fundamental deterioration in the company’s businesses (both top and bottom line are in decline), has resulted in steadily declining margins and returns on capital.

Source: CenturyLink Earnings Release

The major problem facing CenturyLink is that, even though it has managed to grow strongly via acquisitions during the last decade, its strategic businesses (i.e. internet and satellite TV) have failed to offset the strong secular declines in its legacy landline business, which accounts for more than 40% of company-wide revenue.

Leave A Comment