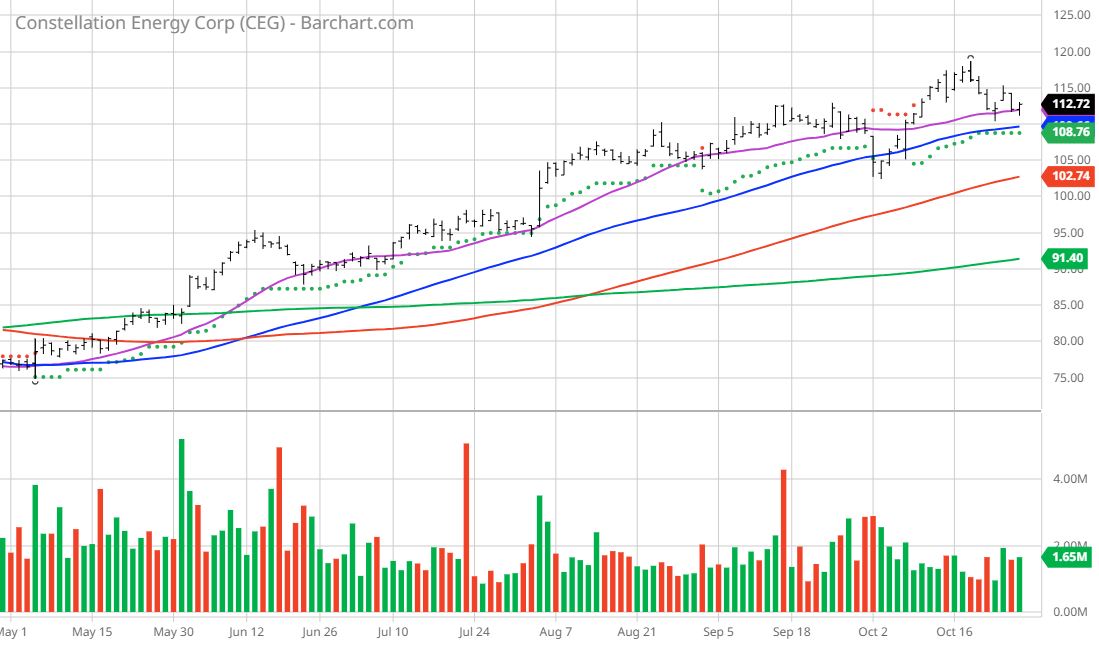

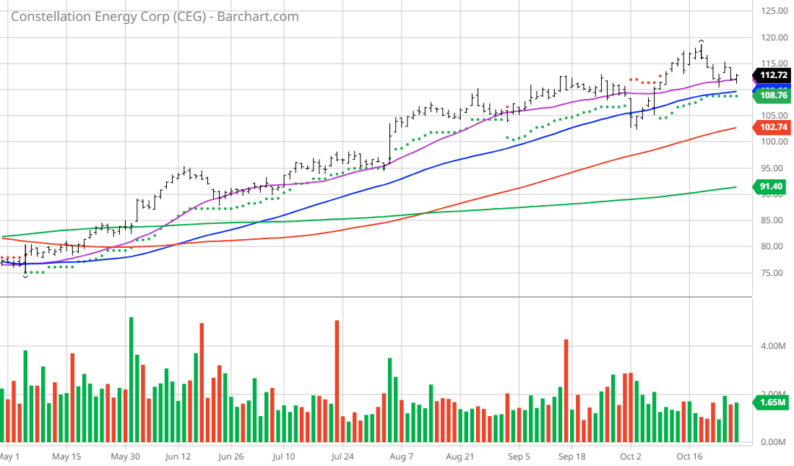

The Chart of the Day belongs to the renewable energy company Constellation Energy (CEG) . I found the stock by using Barchart’s powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation.  CEG Price vs Daily Moving AveragesConstellation Energy Corporation generates and sells electricity in the United States. The company operates through five segments: Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions. It sells natural gas, and other energy-related products and services. The company has approximately 32,355 megawatts of generating capacity consisting of nuclear, wind, solar, natural gas, and hydroelectric assets. It serves distribution utilities; municipalities; cooperatives; and commercial, industrial, governmental, and residential customers. The company was incorporated in 2021 and is headquartered in Baltimore, Maryland.Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the The Chart of the Day website when you read this report. Barchart Technical Indicators:

CEG Price vs Daily Moving AveragesConstellation Energy Corporation generates and sells electricity in the United States. The company operates through five segments: Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions. It sells natural gas, and other energy-related products and services. The company has approximately 32,355 megawatts of generating capacity consisting of nuclear, wind, solar, natural gas, and hydroelectric assets. It serves distribution utilities; municipalities; cooperatives; and commercial, industrial, governmental, and residential customers. The company was incorporated in 2021 and is headquartered in Baltimore, Maryland.Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the The Chart of the Day website when you read this report. Barchart Technical Indicators:

Fundamental Factors:

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

More By This Author:Chart Of The Day: Eli Lilly – Big Profits In Big Pharma

Chart Of The Day: Walmart – Still A Bargain

Chart Of The Day: Microsoft Still Looks Great!

Leave A Comment