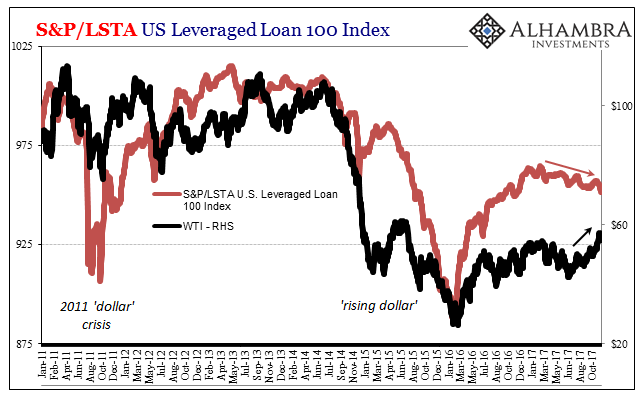

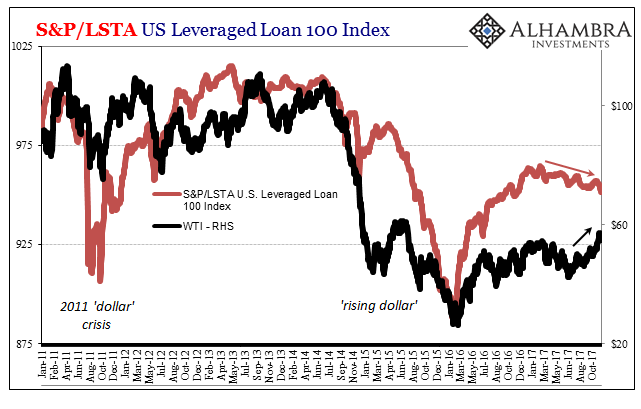

Last week’s Chart of the Week kicks off this week’s, though it will have to wait for a series of explanations to get us from that one to this. A week ago, we noted the growing divergence between leveraged loan prices and WTI, two risk indicators that used to be pretty well correlated for obvious reasons. The S&P/LSTA Leveraged Loan 100 Index did not have a good week this week, while oil was down only somewhat until trading today.

In broader terms, it’s an indication of latent risk being traded in systemic fashion. This extends, of course, beyond US junk credit and oil into currencies like CNY, HKD, RUB, and BRL; i.e., the eurodollar system. It’s the last one that is of interest today and produces our Chart of the Week (at the bottom).

To review recent history for Brazil first as a way of background for it, Banco do Brasil in the radical summer of taper in 2013 began auctioning off swaps as a defensive measure. The real had been under pressure since the end of July 2011 (an especially noteworthy time period), but had appeared to stabilize through 2012 until Bernanke said that magic word the following year.

Dumping to around 2.50 to the dollar, a low almost as bad as Brazil’s worst during the crisis in 2008, the swap regime seemed appropriate. These were not really dollar swaps, though, rather they were more complicated instruments that interfered with the cost of Brazilian banks obtaining “dollars” on global markets (a subsidy). I wrote a short description of this cupom cambial process in October 2013, just a few months after having declared Brazil already toast for doing this very thing.

The way the Brazilian derivatives market works is different than what is implied in mainstream commentary. Without getting too far into those weeds, the Brazilian monetary authorities realized, from past experience with currency depreciation-type emergencies, that they did not necessarily need to offer dollars. Instead, the Brazilian treasury sells, continuously, domestic public debt indexed to US dollar rates.

The Banco’s “swaps”, then, act only on implied future dollar rates, increasing the cupom cambial (the onshore dollar rate implied by currency futures and spreads with dollar rates). In other words, since the central bank “swap” reduces the futures price of dollars in relative comparison to the spot price, there is a greater incentive for banks (both Brazilian and foreign) to borrow US dollars on foreign markets and import them to take advantage of the cupom cambial spread. The swap isn’t really a swap in the conventional sense since the central bank is only swapping dollar indexed securities – deliverable in reals.

Leave A Comment