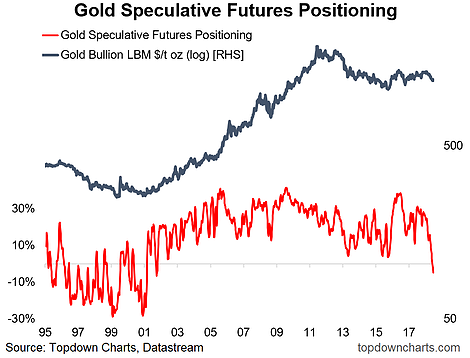

Gold has taken a beating in the last couple of months, and predictably traders have jumped on the bandwagon – pushing net futures positioning to the shortest since the turn of the century. But is this a contrarian signal? Or capitulation selling?

For clarity, the speculative futures positioning indicator is the non-commercial longs minus shorts (standardized against open interest) from the CFTC commitment of traders report. The gold price (GLD) is shown in log terms on this chart.

Leave A Comment