In November 2010, Ben Bernanke wrote the following words in the Washington Post in seeking to justify his decision to renew Quantitative Easing. He started by giving credit to the first round of QE for spurring the initial recovery. It was as if the US economy had never recovered from recessions before without some kind of Herculean money printing scheme. Then he built his case for more QE on the following.

Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

This was Bernanke’s way of enunciating Trickle Down Theory. Print till the cows come home; stock prices will rise, and everybody will get rich, grow more confident and spend like mad, and businesses would invest more to meet demand in a “virtuous circle!”

We know that QE worked all too well to inflate stock prices. But what about Bernanke’s other promises?

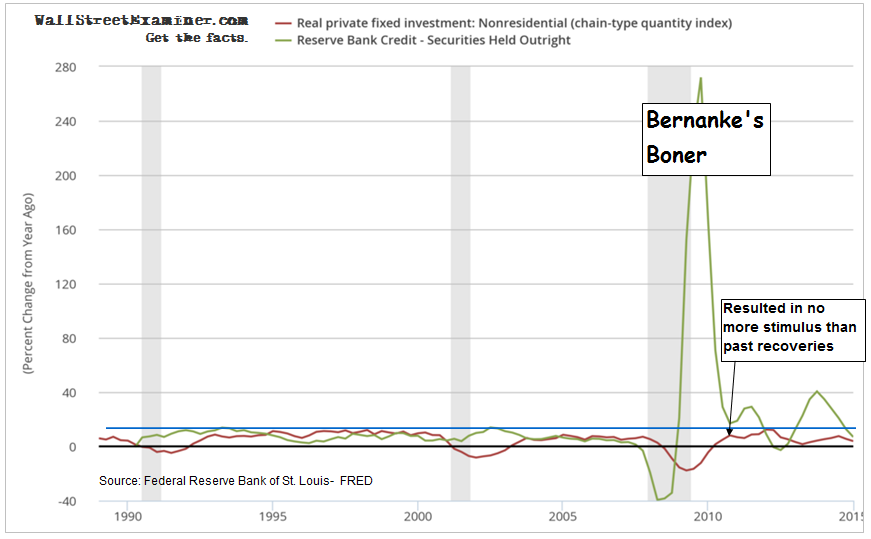

One of the two key tenets in the statement was that QE would raise stock prices, which would ultimately lead to economic expansion. The second was that low corporate bond rates would lead to increased business investment in plant and equipment. Supposedly QE would spur that. How did that work out?

Bernanke’s massive QE didn’t stimulate fixed nonresidential investment. Fixed investment under QE persistently grew at a rate below that of past expansions. It grew faster in the past even though there was no extraordinary monetary policy. The only time in the current “recovery” when investment grew at a rate similar to the past was when investment that had been slashed in the crash was subsequently restored in the rebound. This restoration rebound peaked in the second quarter of 2012. Ironically or not, QE was then in the pause between QE2 and QE3.

Leave A Comment