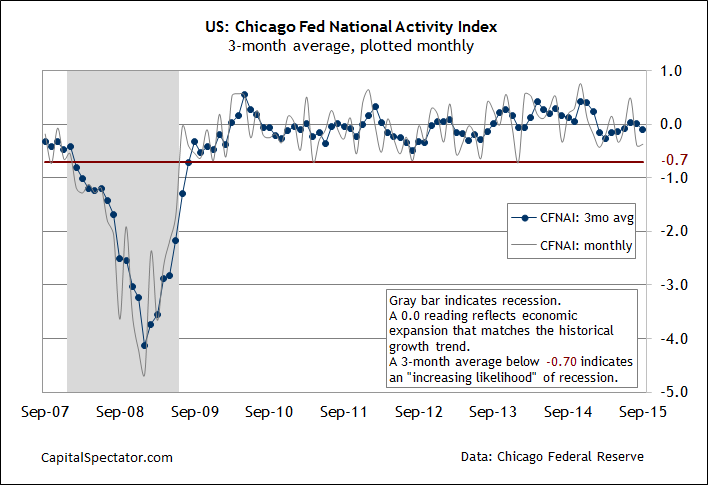

U.S. economic growth was softer than expected in September, according to this morning’s update of the Chicago Fed National Activity Index’s three-month moving average (CFNAI-MA3). Last month’s reading dipped to -0.09, the lowest since this past May. Despite the latest slide, this benchmark of economic activity remains well above its -0.70 tipping point that marks the start of recessions, according to Chicago Fed guidelines. But while the US avoided a downturn last month, it’s clear that growth is still sluggish and will probably remain so for the near term. Indeed, the Atlanta Fed’s current nowcast (as of Oct. 20) for third-quarter GDP is a weak 0.9% (seasonally adjusted annualized rate), well below Q2’s strong 3.9% rise.

As for CFNAI-MA3, the modestly below-zero reading for September “suggests that growth in national economic activity was slightly below its historical trend,” the Chicago Fed said in a statement. “The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.”

The monthly data is even weaker. The index before averaging slumped to -0.37 in September, slightly above the previous month’s upwardly revised figure but otherwise marking the lowest point since February.

The monthly numbers are noisy, however, which is why the Chicago Fed recommends focusing on the three-month average for monitoring the business cycle. By that standard, the economy is still trending positive, albeit at a relatively subdued pace. CFNAI-MA3’s current -0.09 level is fractionally below the zero mark that equates with growth at the historical trend rate.

Analyzing the updated CFNAI-MA3 data with a probit model also shows that the probability is low (roughly 5%) that a recession started in September. The current risk estimate in the chart below is based on a probit regression that reviews the historical record of NBER’s business cycle dates in context with CFNAI-MA3. The low-recession-risk estimate aligns with yesterday’s update of business-cycle risk via The Capital Spectator’s proprietary indexes.

Leave A Comment