Chinese government officials claim that the stock market meltdown in that country is over, and that the rest of the world can expect greater stability from Chinese financial markets in the future.

China Central Bank Governor Zhou Xiaochuan told the Joint Meeting of G20 Finance and Labor Ministers in Ankara on Friday that the stock-market bubble in his country had “burst”. According to a Japanese finance ministry official attending the meeting, the Chinese central banker used the word “burst” three times in his explanation of what is going on with the stock markets.

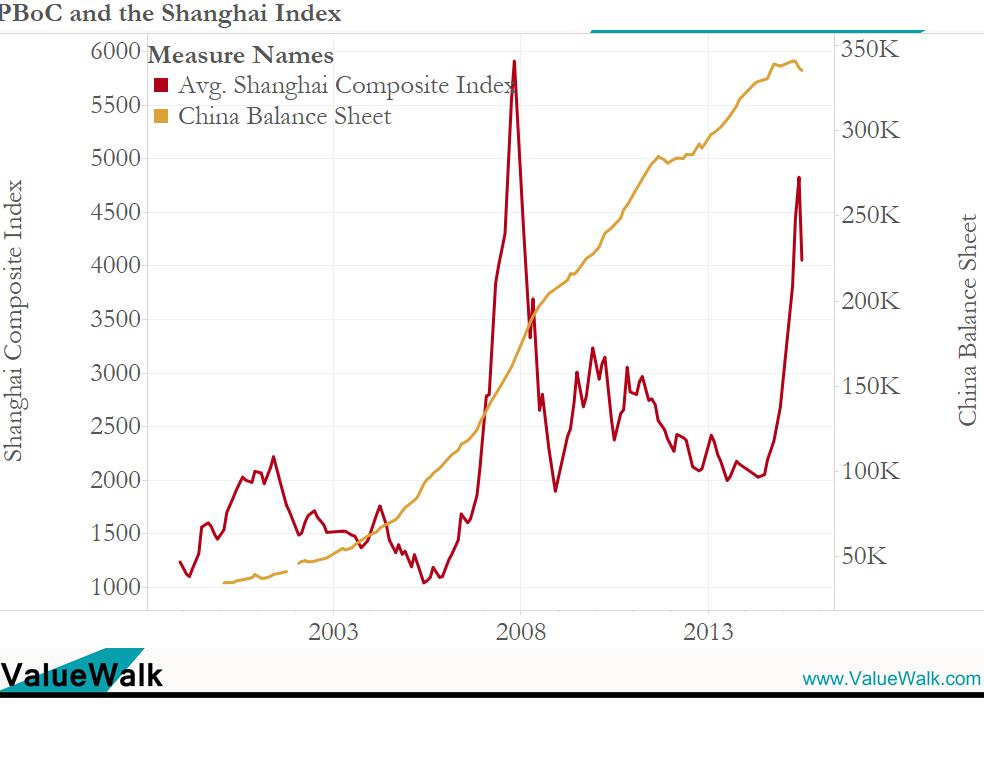

Of note, China’s main equity index, the Shanghai Composite, is down close to 40% since hitting a three-year high earlier this summer.

More on China at Ankara G20 meeting

Several sources are reporting the Chinese delegation at the Ankara G20 meeting saying that they were shifting to a different economic growth model and trying to minimize disruptions. They argued that they were working to lower indebtedness and are planning new policies that will help control stock market volatility.

“China is definitely trying to play a constructive role,” Canada’s Finance Minister Joe Oliver commented in a presser Friday. “It is the second-largest economy in the world and so when it slows down it has global implications. That is I think what we are dealing with.”

China explains yuan devaluation

One source who attended the meeting said he China central bank governor told the group that its currency devaluation wasn’t an effort to take exports from other countries and that explanation was accepted by the other leaders, according to an article by Greg Quinn, James Mayger, and Sharon Chen of Bloomberg News.

“No one can predict exactly on the market volatility, but I’m confident that the renminbi exchange rate will be more or less stable around the equilibrium level,” Yi Gang, China’s deputy central bank governor, noted in an interview. “The Chinese economy’s fundamentals are fine.”

Leave A Comment