Despite downgrades from the rating agencies, China is issuing its first sovereign dollar bond issues in 13 years on an unrated basis (what do the agencies know anyway) and at tight spreads to US Treasuries. The 5 and 10-year issues come just over a month since S&P cut the nation’s rating one level to A+ on 21 September 2017. Moody’s had already cut to single A.

Bloomberg reports that China began marketing its first sovereign dollar bonds since 2004 following a week when Chinese leaders in Beijing outlined a greater role for the nation on the world stage. The Ministry of Finance is offering $1 billion of five-year notes at a spread of 30 to 40 basis points over Treasuries, and the same amount of 10-year debt at a premium of 40 to 50 basis points, according to people familiar with the offering, who aren’t authorized to speak publicly…China is offering the bonds unrated, in a break with traditional practice by sovereigns in the region when they sell dollar notes. S&P Global Ratings last month followed Moody’s Investors Service in cutting China’s sovereign rating, citing soaring debt and increased economic and financial risks. The debt sale is one of the most eagerly anticipated in Asia this year…

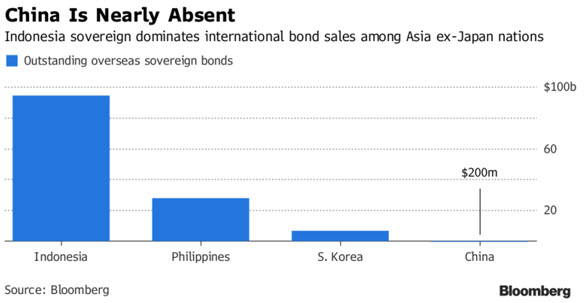

The sovereign itself has been a rare issuer in foreign currencies and has only ever sold the equivalent of about $11 billion of such notes, according to data compiled by Bloomberg.

The order books exceeds 22 billion dollars, according to Bloomberg.

The lack of a formal rating on the Ministry of Finance of the People’s Republic of China’s dual-tranche U.S. dollar bond offering isn’t impeding the sale as the order books are reported to exceed $22 billion at initial price guidance as the books move to Europe…

Key comparable bonds include Japan Bank for International Cooperation’s $1.25 billion 2.875% due July 2027 which was quoted around T +43 basis points, State of Israel’s $1 billion 2.875% due March 2026 which was quoted around T +41 basis points and Germany’s KFW’s $2 billion 2% due May 2025 which was quoted around T +4 basis points…

China’s first sovereign dollar bond offering since 2004 is being lead managed by Bank of China, Bank of Communications, Agricultural Bank of China, China Construction Bank, CICC, Citigroup, Deutsche Bank, HSBC, ICBC and Standard Chartered Bank

Leave A Comment