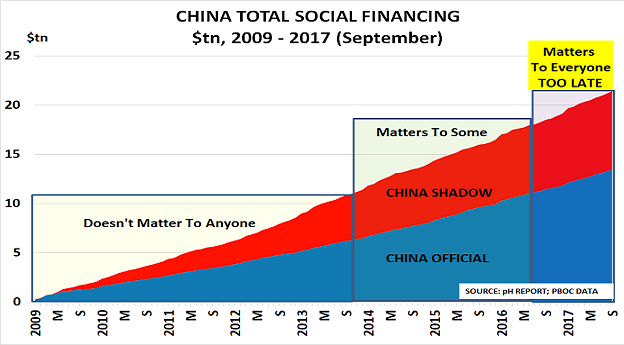

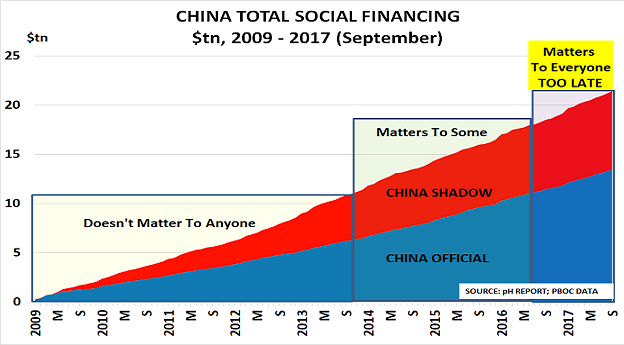

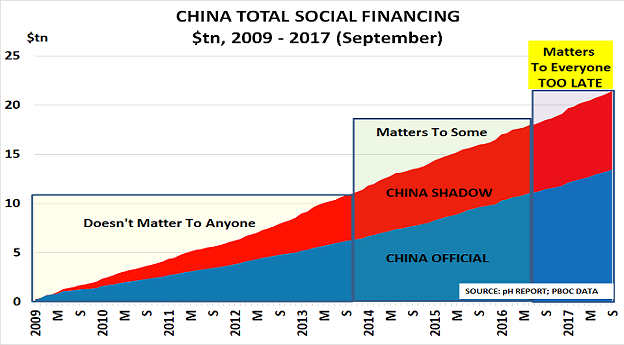

The world is coming to the end of probably the greatest financial bubble ever seen. Since the financial crisis began in 2008, central banks in China, the USA, Europe, the UK and Japan have created over $30tn of debt.

China has created more than half of this debt as the chart shows, and its total debt is now around 260% of debt. Its actions are therefore far more important for global financial markets than anything done by the Western central banks – just as China’s initial stimulus was the original motor for the post-2008 “recovery”.

Historians are therefore likely to look back at last month’s National People’s Congress as a key turning point.

It is clear that although Premier Li retained his post, he has effectively been sidelined in terms of economic policy. This is important as he was the architect of the stimulus policy. Now, President Xi Jinping appears to have taken full charge of the economy, and it seems that a crackdown may be underway, as its central bank chief governor Zhou Xiaochuan has been explaining:

Zhou first raised the issue at the National Congress last month, warning of the risk of a “Minsky Moment” in the economy, where debt or currency pressures could park a sudden collapse in asset prices – as occurred in the US subprime crisis. “If there are too many pro-cyclical factors in the economy, cyclical fluctuations are magnified and there is excessive optimism during the period, accumulating contradictions that could lead to the so-called Minsky Moment. We should focus on preventing a dramatic adjustment.”

Then last week, he published a warning that “China’s financial sector is and will be in a period with high risks that are easily triggered. Under pressure from multiple factors at home and abroad, the risks are multiple, broad, hidden, complex, sudden, contagious, and hazardous. The structural unbalance is salient; law-breaking and disorders are rampant; latent risks are accumulating; [and the financial system’s] vulnerability is obviously increasing. [China] should prevent both the “black swan” events and the “gray rhino” risks.”

Leave A Comment