Last night, when previewing the most important macro event of the day – far more important than US retail sales which predictably tried to refute the gloomy reality reported by actual retailer CEOs – namely China’s montly loan creation number, we said that “according to MarketNews, Chinese bank loan growth is expected to slow sharply in April compared with March as the pillar of bank lending, mortgage loans, slowed as the property market cooled.” Citing bank officials, MNI said that combined new loans in April by the Big Four state-owned banks were more than halved from March’s level.

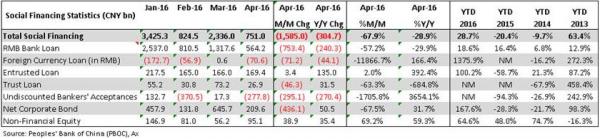

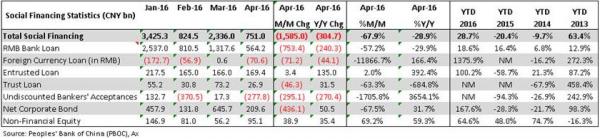

This is precisely what happened just a few hours later, when the PBOC reported April credit growth and monetary data all of which came solidly below expectations, to wit:

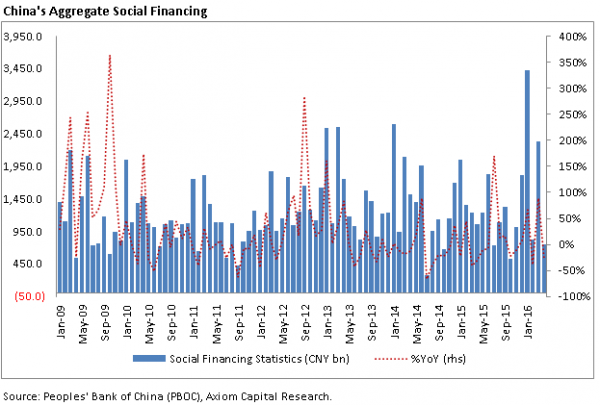

The chart below from Axiom shows not only the sharp slowdown in TSF, but that at CNY751BN, it was effectively unchanged from a year ago, something China can not afford as the only way China’s economy will keep growing is if its total loan growth grows at a substantial pace above GDP.

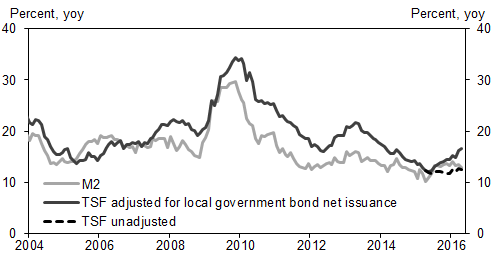

Perhaps most important was the substantial slowdown in the growth rate of China’s all important M2, which rose 12.8% yoy in April (3.2% SA ann mom) vs. consensus: 13.5% yoy. and down from March: 13.4% yoy.

This is Goldman’s take on the data:

Slower credit growth in April was likely the partial result of tighter liquidity conditions in the interbank market. Administrative controls might have played some role as well. Higher yields and credit spread may also contributed given the decrease in corporate bond net issuance under TSF. There were also some crowding out effects of very large amount of local government bond issuance which were mostly bought by banks.

Fiscal deposit change was a major drag on M2 growth. Fiscal revenue growth was as high as 14.4%, mainly because of attempts by the government to collect the last month’s operation tax before they are abolished and changed to VAT. Fiscal expenditure growth slowed after very strong growth in March, which was impossible to maintain. FX flows were likely relatively stable with no major outflow nor inflows.

April money and credit data indicate that tweaking of the policy stance likely started in April, before the late April Politburo meeting and early May People’s Daily editorial suggesting less stimulative policies. Such a change is unsurprising given the rebound in activity growth,rising concerns about inflation and leverage. To what extent the latest policy comments will have additional impact on policy in May and beyond is uncertain, but we believe 2Q policy as a whole is most likely to be less supportive than 1Q. Domestic investment demand growth as a result will likely receive less support.

Leave A Comment