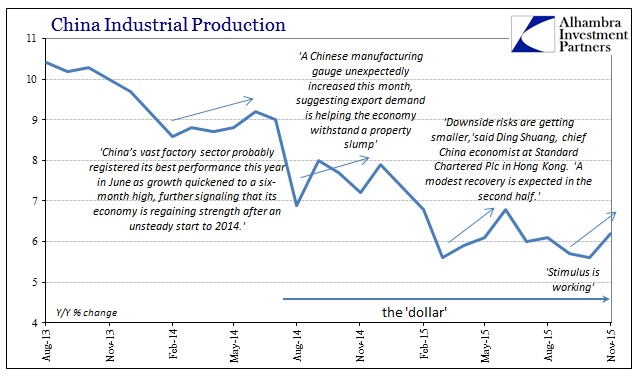

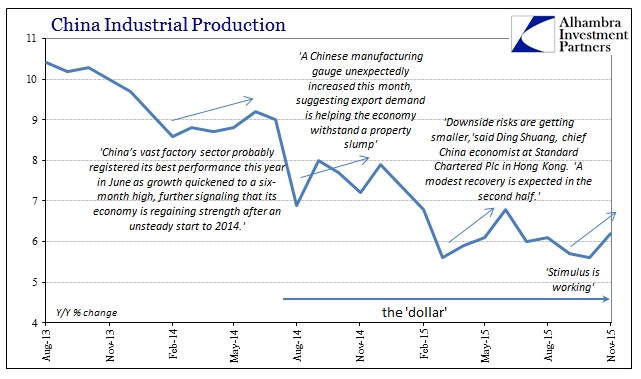

Industrial production in China accelerated in November to 6.2% from an abysmal 5.6% in October. As per usual, any similar change is met with assurances that this time, unlike all prior, everything is working. It has become a regular game of ill-considered contention, as every single move in IP or some other factor that stops declining is immediately and confidently declared definitive in extrapolation. This has been true of variability lasting just one month or several months, as every time it is “proof” “stimulus” is performing and every time it fails to continue along the extrapolation.

“It’s pretty good news in a way, that the stimulus is finally working,” said Mizuho Securities Asia economist Shen Jianguang. “It’s definitely not a major turnaround. But it is good to have a reversal of the downward trend.”

Saturday’s industrial-production data, the indicator’s first acceleration in four months, suggests that stimulus policies are gaining traction. Over the past year, Beijing has cut interest rates six times, pushed through hundreds of infrastructure projects and cut required bank reserves several times, freeing up more money to lend.

The problem with the “stimulus” view is basic central bank and eurodollar math (subscription required), a factor that nobody seems to consider. That isn’t all that surprising since orthodox views on such things demands little actual scrutiny other than saying or writing the word “stimulus.”

Beyond the raw monetarism, there is the larger economic context for 6.2%; in truth, 6.2% isn’t different from 5.6% as both are almost equally atrocious. Industrial production has been at or below 8% forsixteen straight months, a lingering depravity of volume not seen since the 1990’s. November’s “hopeful” acceleration would qualify as the third worst month of the Great Recession where only three months in total, and not consecutively, had IP been less than 8%.

Leave A Comment