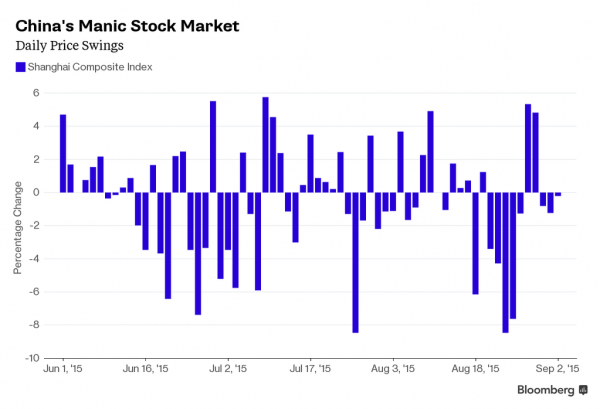

Since today was the last day of trading for Chinese stocks this week ahead of the 4-day extended September 3 military parade holiday to mark the 70th anniversary of the allied victory over Japan, and since Chinese stocks opened to yet another early -4.7% rout coupled with the PBOC’s biggest Yuan strengthening since 2010 as we observed earlier, there was only one thing that was certain: massive intervention by the Chinese “National Team” to get stocks as close to green as possible.

Sure enough they tried, and tried so hard the “hulk’s” green color almost came through in the last hour of trading …

…. yet, despite the symbolic importance of having a green close at least one day this week ahead of China’s victory over a World War II foe, Beijing was unable to defeat the market even once in the latest week…

This takes places as China has thrown the proverbial kitchen sink at the market and achieved nothing. As a reminder,the FT reported yesterday in their most recent desperation scramble, four Chinese regulatory agencies issued a joint statement “encouraging” listed companies to hand out more dividends, buy back their own shares and carry out more mergers and corporate restructurings to boost slumping share prices. The statement from the finance ministry and the regulators in charge of securities, banking and state-owned assets was issued after Beijing’s decision to end its large-scale but unsuccessful programme of direct stock purchases.

State-owned funds and financial institutions have spent more than $200bn since early July trying to prop up the market but benchmark indices have still fallen 40 per cent from their peak of early June. The government has decided to abandon these share purchases and concentrate instead on boosting the slowing real economy, “improving the quality of the equity market” and arresting people deemed to be manipulating the market. In their statement, the four agencies pledged to step up the restructuring and mergers of listed state enterprises to make them more attractive to investors.

The statement also said the agencies would “actively encourage” listed companies to issue more cash dividends, a practice that is relatively rare among companies listed on mainland Chinese stock exchanges. The agencies will facilitate share buybacks by listed companies through regulatory measures that, analysts said, could include tax breaks. Buybacks would take place when share prices fall below net asset value.

And since everything China has tried so far, even arrests and threats, has failed, this bodes very poorly for Chinese stocks come next week because while the FT previously bombastically reported that the “National Team” will no longer intervene over the weekend, only to do just that for 3 consecutive days, at least it had a patriotic alibi. After Sunday, all bets are off.

On the whole, Asian equity markets traded mostly higher for a bulk of the session before falling back into negative territory before the close, with the Shanghai Comp. (-0.2%) paring as much as 4.7% of losses as investors readjusted positions ahead of the long weekend, while brokerages also announced additional funds to back China Securities Finance Corp and support China’s stock markets. Nikkei 225 (-0.4%) outperformed for most of the session amid short covering and JPY weakness before seeing some weakness as European particpants came to their desk, while ASX 200 (-0.86%) was weighed on by the energy sector after WTI posted its largest intraday decline in 7 months. JGBs traded mildly lower following the strength in Japanese equities, while losses were stemmed as the BoJ entered the market to purchase JPY 1.2trl of government.

Over to Europe, where cautious sentiment dominated the price action, with stocks in Europe again trading on the back foot (Euro Stoxx: -0.3%) as market participants were left somewhat uninspired by the lack of firm actions by Chinese officials to prevent the flight of capital. Energy names underperformed on the sector breakdown, whereas the more defensive sectors, such as healthcare traded in the green. Despite the ongoing downside in global equities, analysts at Morgan Stanley issued a buy alert on stocks for the first time since early 2009. Such calls typically lead to a V-shaped recovery that delivers a 23% gain in stock prices over the following 12 months.

Leave A Comment