Chinese exports in December were better than feared, declining by just 1.4% against some expectations for an 8% decline. However, there were significant questions in the data, starting with year-end contract projections, unverified accounts that don’t match other countries’ trade figures and the return of Hong Kong as a potential falsification point. As ZeroHedge points out, without the huge jump in Hong Kong activity the export figures would have been more in line with recent months.

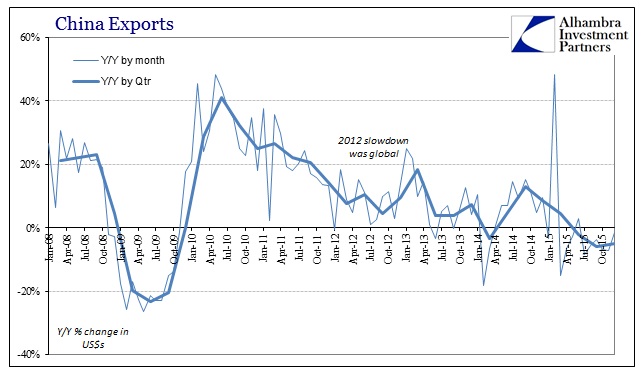

While economists were taking comfort with -1.4%, for the quarter exports declined 5.1% which was practically the same as the -5.9% from Q3. The trend is still undeniably weak, with the past five quarters projecting nothing but continued disappointment; +8.5% Q4 2014; +4.6% Q1 2015; -2.2% Q2 2015, including the last positive number for exports; -5.9% Q3 and -5.1% Q4.

The true nature of the unfolding disaster is revealed by wider context, where the argument over whether -1.4% is really an improvement is put to rest. As noted month after month, China’s industrial capacity was built upon the premise of not positive growth but growth that averaged 20-40% year in and year out. The export numbers in 2015 confirm that either the global economy suddenly stopped buying so much of its goods from China, or the global economy suddenly stopped. Those are the only two possibilities; the only way to explain why China was exporting at 30% before 2008 and then again, briefly, just after, but now can’t even maintain a steady level.

The amount of leverage that went into maintaining capacity growth even as actual activity fell off starting in 2012 is simply enormous, and that explains why so many financial fears plague almost every facet of the Chinese markets now. This would include the “dollar” connection, which has suffered the most visible nature of the disaster. I also think that helps explain, partially, why Chinese imports have collapsed at a far greater rate than exports. The troubled ability to directly source eurodollars reduces the currency available to conduct actual economic trade. Along with the internal bubble dynamics no longer supporting marginal expansion, the result is an ongoing trade disaster where China’s negative output in exports is amplified to the rest of the world via stark reductions about imports.

Leave A Comment