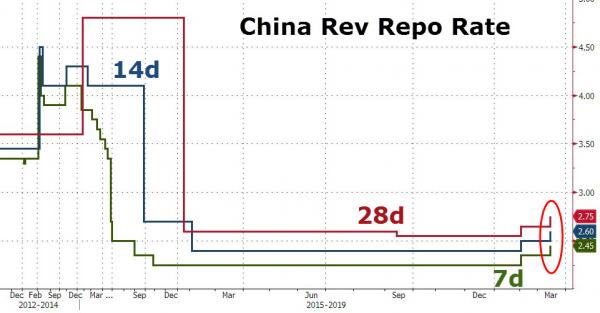

Following The Fed’s 3rd rate hike in 11 years, the PBOC decided, unexpectedly, to follow in the Fed’s footsteps, and tighten conditions by raising the interest rates on its open-market operations, the 7-, 14-, and 28-day reverse-repos, by 10bps each, to 2.45%, 2.6% and 2.75% respectively.

That followed an increase of 10 basis points at the beginning of February, which in turn was the first increase in the 28-day contracts since 2015 and since 2013 for the other two tenors.

One month ago, the PBOC also – for the first time ever – increased the rate on the PBOC’s Medium-Term Lending Facility, or MLF. It did it again on Thursday, when the PBOC conducted CNY303 billion in 6-month and 1-year MLF, where the interest rose by 10bps, from 2.95% to 3.05%, and from 3.1% to 3.2%, respectively.

What to make of this tightening? According to the PBOC nothing: the Central bank said there was “no need to over-interpret monetary tools action” and added that higher open market operation interest rates don’t mean benchmark interest rates are increasing.

Except they are, of course, especially since like in western nations, increasingly it is narrowly confined liquidity conduits that matter instead of broad, shotgun market rates.

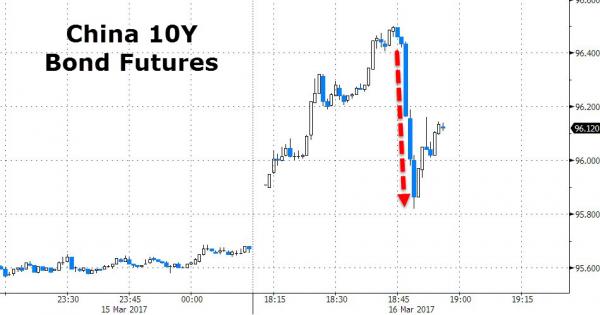

Naturally, this was not exactly great news for those hoping for a renewed credit impulse to lift the tumbling GDP expectations of the world in Q2. For now the reaction is minimal with Yuan leaking lower, erasing the gains against a weaker post-Fed dollar.

China bond futures took a hit.

As Bloomberg’s Kyoungwha Kim reports, the PBOC is swift enough to raise the repo rates but will stop short of raising the key interest rate, following the Fed. The huge wall of debt set to mature over the next two years will likely keep the PBOC from raising the key rate even as the Fed hikes away. It will probably continue to use higher money-market rates to discourage leverage. While Chinese money market rates and sovereign yields are still showing declines due to delayed prices, traders say they are seeing reaction in the interbank market already.

Leave A Comment