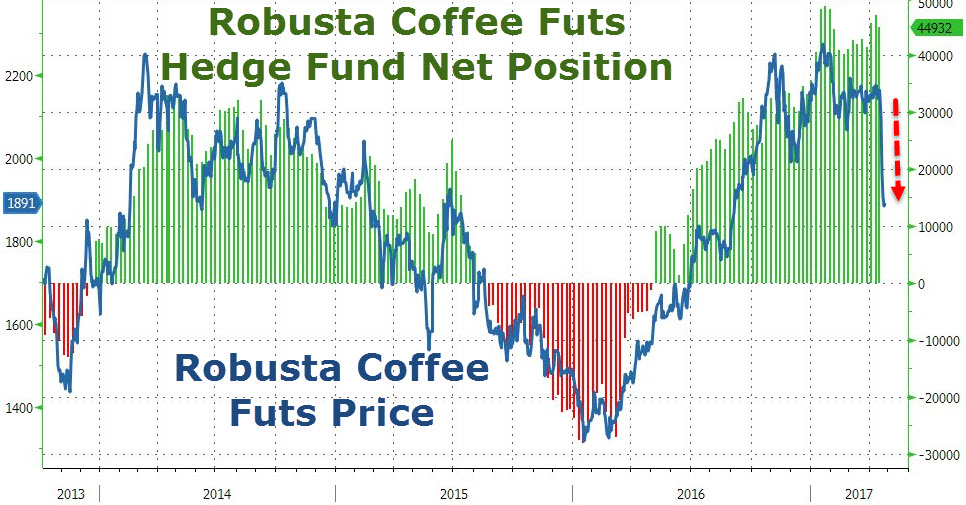

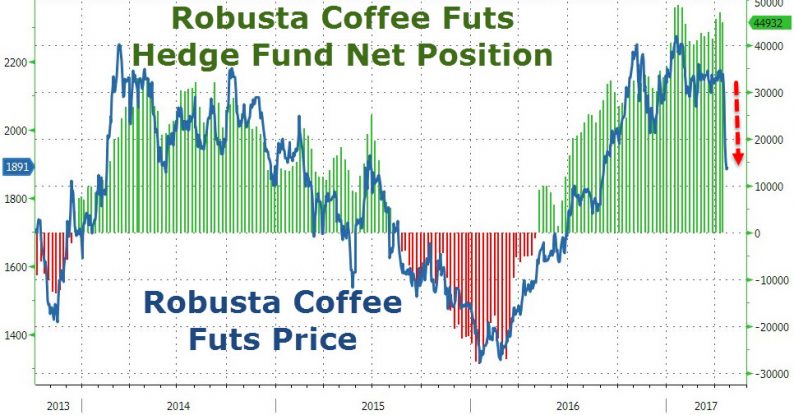

The ‘smart money’ was disastrously wrong… Having piled herd-like into near record-high bullish positions in Robusta futures (used in instant coffee) over the last year…

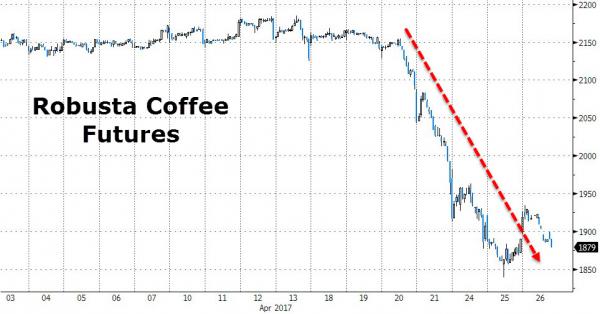

Hedge funds face coffee carnage this week as the price for the commodity collapsed over 13% in the last 6 days…

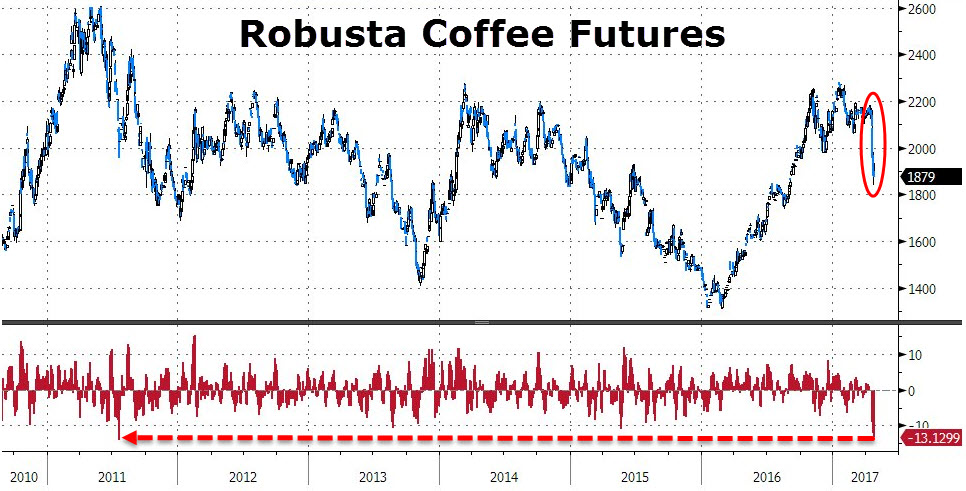

The biggest bloodbath since July 2011…

As Bloomberg reports, while the market is facing a third annual shortage, more supply from key growers has eased concerns about short-term tightness and cut-price gains in the past year to 22 percent. The slump over the past week pushed prices below both the 100-day and 200-day moving averages, levels often used by traders to predict future moves. Robusta’s 14-day relative strength index has fallen to about 19, signaling prices may have dropped too fast.

“The robust bull market could be over for the rest of the year,” Carlos Mera Arzeno, a commodities analyst at Rabobank International in London, said by email. “The price is falling due to a combination of fundamental and technical reasons. You have large non-farmer stocks in Vietnam and Indonesia, and also funds selling, regardless of the fundamentals.”

“Funds that are still long will be hit, and those funds tend to be fundamentals-based,” Arzeno said.

Leave A Comment