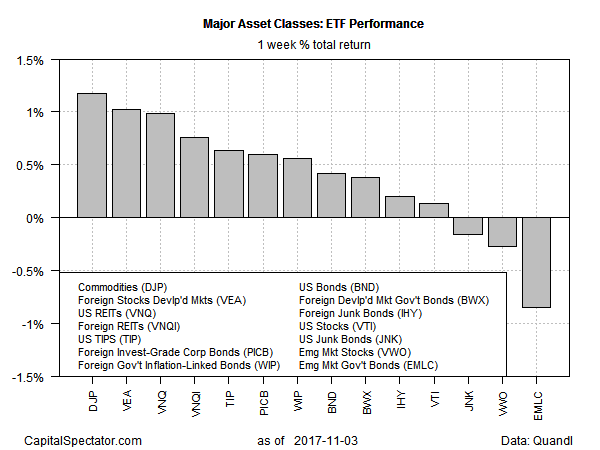

Broadly defined commodities posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products. The advance marks the second time in as many weeks that commodities topped the performance list.

The iPath Bloomberg Commodity (DJP) was up 1.2% for the five trading days through Friday, Nov. 3. The second weekly advance lifted DJP to its highest close in nearly nine months.

A recent report by Goldman Sachs noted that demand for commodities this year has been robust. “[A]ll markets are currently facing the best demand backdrop in over a decade with strong global synchronous growth,” the bank advised.

Meantime, emerging markets have been on the defensive lately. Equities and bonds in these countries were the biggest losers last week for the major asset classes. VanEck Vectors JP Morgan EM Local Bond (EMLC) posted the biggest decline. The fund fell 0.9%, marking the third weekly decline that left EMLC at its lowest close since May.

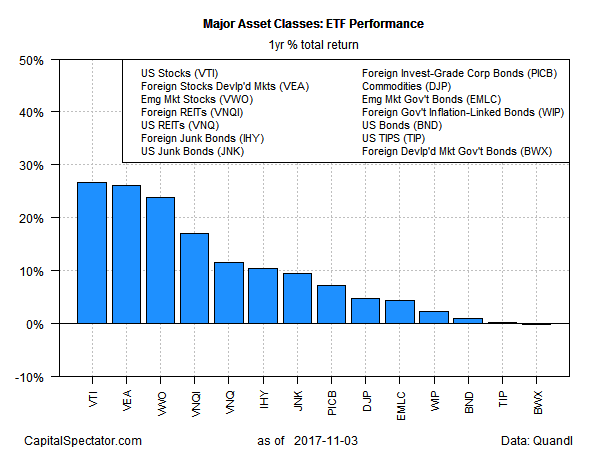

For the one-year change, the US stock market continues to outperform the rest of the field, albeit by a small margin vs. the second- and third- place runners-up: foreign equities in developed and emerging markets, respectively.

Vanguard Total Stock Market’s (VTI) total return is currently a strong 26.8% for the past 12 months, or just ahead of the second-strongest one-year performer: Vanguard FTSE Developed Markets (VEA), which is ahead by 26.2%. In third place: Vanguard FTSE Emerging Markets (VWO), which is up 23.8% over the year-earlier level based on total return.

Leave A Comment