This market is now communicating that it is at high risk. For two months now, I have been advocating a strategic retreat. Head for the sidelines and watch the action with an unemotional detachment. The market is now sounding the alarm and one should be on high alert for a downside acceleration.

Plunger’s Bullet Points

Here are the main points I have presented over the past few weeks:

The largest financial bubble in history is concluding and one should prepare his bomb shelter and know how to protect oneself.

Supreme Complacency

I am standing on a mountaintop and shouting-REDUCE YOUR RISK

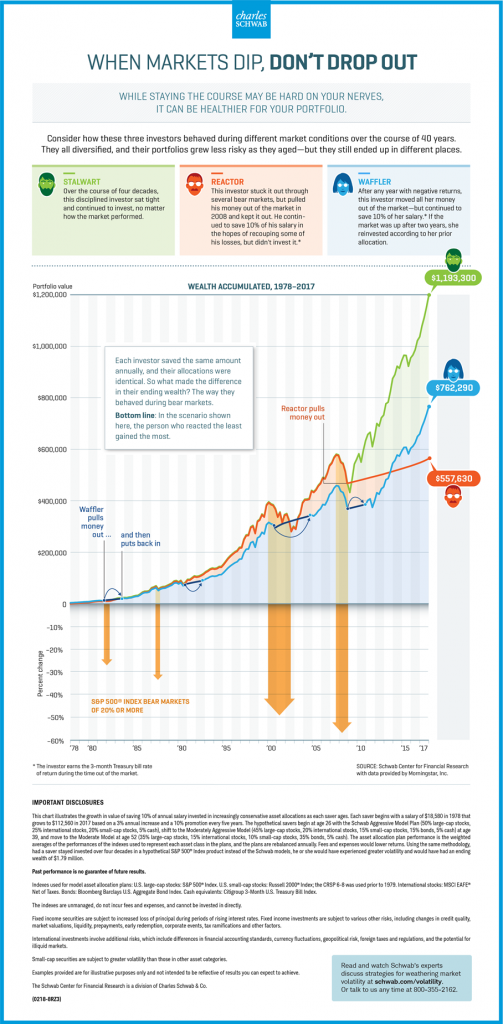

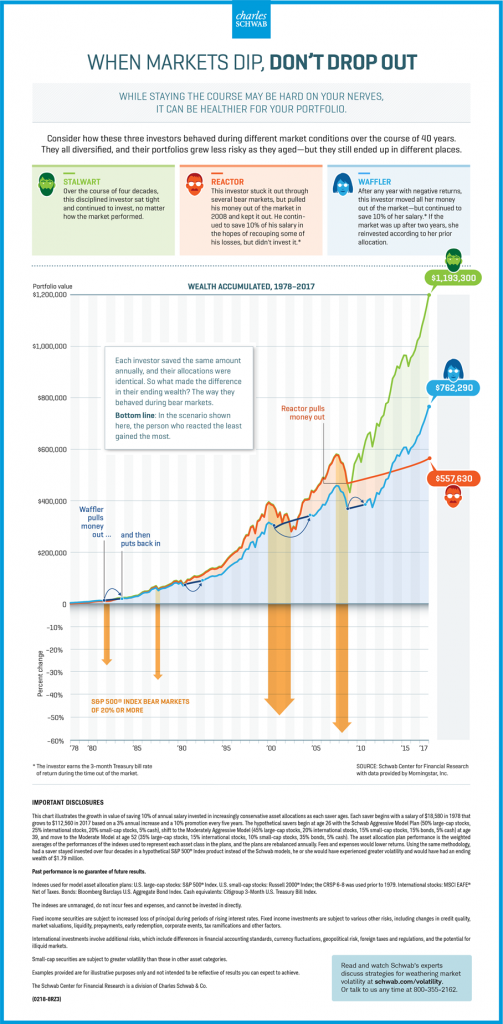

Am I calling for a crash? – No, I am not, however, conditions exist which would allow a crash to happen. We are now 2 months after the highs put in by the major indexes worldwide. This is the timeframe that crashes have traditionally occurred. 1929 and 1987 are classic examples. Complacency reigns supreme as dip buyers are getting lathered up for another romp to the upside. Don’t believe me? Check out this Charles Schwab email I received in my inbox and don’t miss the name of it:

Bullish Investors typically continue buying one-third of the way into a bear market, up until the point of recognition. After this point, the pain becomes too great and they then retreat.

The arrogance and cluelessness of both the average investor and the financial establishment astounds me. Take the Fed, they think they can create $4.5 T of QE and then simply yank $1.8 T of it right out of the market while simultaneously increasing government borrowing by $1.2 T/year, all while threatening the largest buyer of T-Bonds with a trade war! So after years of QE they think they can just turn the dial the other way and reverse it… astounding. Problem is, it doesn’t work that way.

This historic giant bubble is in the process of bursting- it’s now just a matter of time.

But enough of what Plunger has to say, let’s turn our eyes towards the market and listen to its message. You know the line: I report…you decide:

Leave A Comment