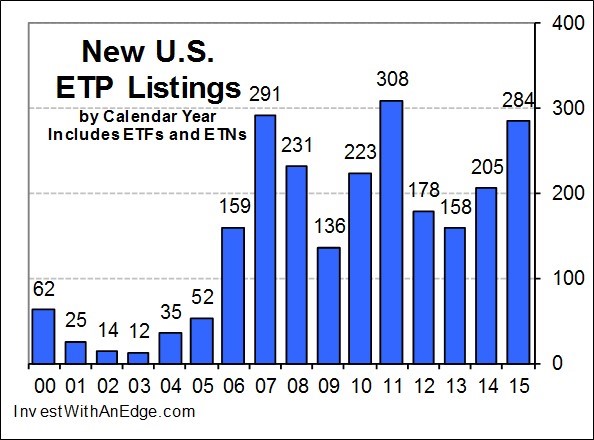

Exchange-traded product (“ETP”) launches totaled 284 in 2015, consisting of 272 new exchange-traded funds (“ETFs”) and 12 exchange-traded notes (“ETNs”). Only 2011 and 2007 had more ETP launches than 2015 (308 and 291, respectively).When combined with the 101 closures for the year, the net increase of active listings for 2015 was a more modest 183.

We separate ETPs into nine major groups (shown here with the number of launches in each category in 2015):

Based on these divisions, the Global & International category was easily the largest contributor with 102 new products. The major reason for this was the success of currency-hedging strategies the past few years, which has created a land-rush of sponsors scrambling to bring out hedged versions of existing funds. Fully half of the Global & International ETFs introduced in 2015 employ currency hedging.

The Style & Strategy category was home to the second-largest contingent of new ETFs in 2015. Similar to the positive impact of currency hedging on international funds, this group also had a catalyst in the form of factor investing, or smart-beta funds. There were 79 new products in this category, and all but six employ smart-beta strategies.

Sector funds remain popular, and 30 more came to market in 2015. Smart beta is a theme in this category also, with 14 of the new sector offerings using alternative weighting schemes. Additionally, three currency-hedged sector ETFs were introduced, all targeting international Real Estate. New bond-fund offerings remain popular with 29 making their debut during the year. Just one employed currency-hedging, but five are interest-rate hedged in an effort to mitigate the impact of rising interest rates.

Two dozen leveraged ETFs came to market with 15 targeting sectors, five focused on international markets, and four providing enhanced exposure to style and strategy-oriented equities. Sixteen new inverse ETFs were brought out, and all but three of them also use leverage.

The long-term bear market for commodities is having a detrimental effect on the Commodity category, which saw only two new products for the year. Likewise, only two Volatility funds came out in 2015. Investors are disappointed in this category, and traders seem to have settled on another product as their favorite volatility trading vehicle.

The Currency category saw no new releases in 2015. However, slicing the data differently can help identify industry trends, such as the previously mentioned 57 new entries that use currency hedging. Currencies are still important, but for most investors, currency-hedged ETFs are a more efficient use of capital than having to maintain separate currency positions. On the theme of hedging, five of the new products are interest-rate hedged, and a dozen employ equity hedging with long/short strategies. Volatility-hedged products were popular in prior years, but none came to market in 2015.

Here are the new launches with unique features:

As the list above indicates, alternative beta was easily the dominant theme of 2015. In its simplest form, smart-beta and alternative beta products are defined as those using something other than a traditional capitalization weighting methodology. You might also hear them referred to as products breaking the link between security price and weighting. This was a widely discussed trend in 2014 when more than a quarter of the product launches fit this description. The trend clearly accelerated in 2015, grabbing a nearly 59% market share of product introductions.

With interest rates remaining near historic lows, sponsors continue to pump out dividend funds for income-oriented investors that desire more cash flow than the paltry yields most bond funds can deliver. The large jump in the quantity of Fund-of-Funds, ETFs that buy other ETFs and ETNs instead of directly owning the underlying securities, is due to the currency-hedging craze. For example, instead of duplicating the 217 holdings of the unhedged iShares MSCI EAFE Minimum Volatility ETF (EFAV), the new iShares Currency Hedged MSCI EAFE Minimum Volatility ETF (HEFV) just buys EFAV and overlays it with a currency hedge.

Actively managed ETFs had 56 new entries in 2014, and another 27 came out in 2015.The introduction of master-limited-partnerships (”MLPs”) products slowed dramatically, as the segment is becoming saturated and the existing products experienced dismal performance in 2015. Fortunately, no new ETFs using the dreaded C-Corporation structure arrived during the year.

BlackRock (BLK) released the most ETFs again with 45 new products carrying the iShares brand name. Other sponsors with double-digit product introductions in 2015 included Direxion with 26, ProShares 19, Deutsch Bank (DB) X-trackers 19, WisdomTree (WETF) 17, State Street (STT) SPDRS 15, UBS (UBS) ETRACS 11, and Global X 10.

These 284 new products were able to gather nearly $11 billion in assets before the end of the year. Those with the most assets included SPDR DoubleLine Total Return Tactical ETF (TOTL) $1.8 billion, SPDR S&P North American Natural Resources (NANR) $692 million, iShares Exponential Technologies (XT) $635 million, and Goldman Sachs ActiveBeta Emerging Markets Equity (GEM) $571 million. Since funds launched in January had 12 times as many months as those launched in December to attract assets, the year-end asset levels do not necessarily reflect the fastest-growing products.

The table below lists all 284 new products sorted by launch date. The IPO date is the first day the product was listed and available for purchase. A fund’s first trade may be a later date in some cases, as a few products do not have any first-day volume. Additionally, the “inception date” listed for many ETFs from other data providers is typically a meaningless date, as it is often a day or more before it actually becomes listed and available for purchase.

New ETFs and ETNs for 2015

Leave A Comment