One week after we observed the biggest monthly short squeeze in 10Y TSYs in history, it was a relatively calm week in the longer-end of the Treasury curve.

According to the latest CFTC data, spec net shorts in aggregate Treasury futures was little changed from the previous week at 612K contracts in TY equivalents. While, they continued to pare net shorts in TU and TY by 18K and 14K contracts, respectively, they increased theirnet shorts in FV and TN by 35K contracts and 6K contracts, respectively. Spec net shorts as share of open interest was unchanged at -5.8% over the week and was at about -2.0 standard deviations away from neutral.

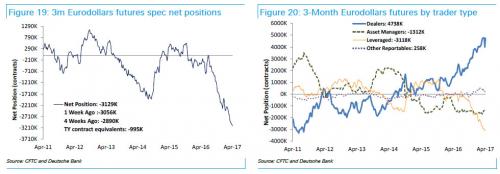

While net Treasury futures shorts are now back to the lowest levels since early December 2016, traders continued to pile into the short-end betting massively on further rate hikes as Eurodollar shorts push on beyond $3 trillion: in the last week specs sold another 73K contracts in Eurodollar futures, taking their net shorts to the seventh successive week of record high of -3,129K contracts.

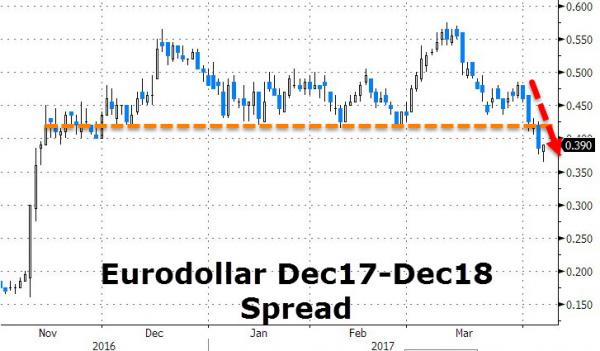

What is surprising is that there was no short covering after Bill Dudley’s March 31 comments which were taken as dovish by the market, sparking EDs to flatten and reds to outperform on potential for a less hawkish Fed in 2018, which as we observed last week prompted a collapse in the Eurodollar 2018 spread (EDZ7/EDZ8) to briefly slide below a key support level on what was seen as the last sign of “reflation trade” capitulation on the front end.

While the mid-week CFTC report captured the market reaction to the initial round of Dudley comments, it failed to take into account Dudley’s Friday “little pause” discussion, which as we quoted RBC on Friday afternoon, prompted “we observed .”

The confusion following the contradictory Dudley statements prompted Morgan Stanley to announce on Friday that it was taking off its EDZ7/Z8 flattener, but keeping a EDZ7/Z9 flattener. This is what Morgan Stanley’s Matthew Hornbach said over the weekend:

Leave A Comment