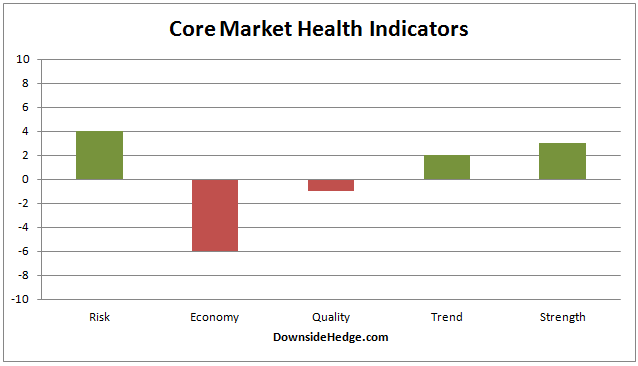

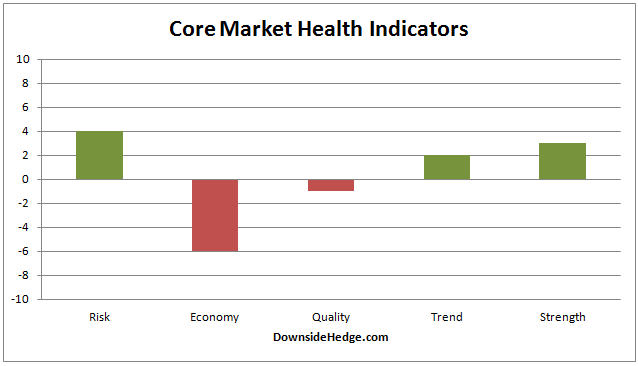

Over the past week all of my core market health indicators fell. However, they’re holding up relatively well considering the price destruction in the S&P 500 Index (SPX). Even the sharp decline of the past two days isn’t doing serious damage. As a result, this looks like consolidation of the steep rally that started in late September rather than the start of a new down trend. Things can change, but for now it looks like normal profit taking after a strong rally.

Two of four components of my market risk indicator are currently warning, but the other two are quite far away from a warning. This is in contrast to the panic that occurred the last time SPX fell below 2040. Currently, I judge market risk as moderate.

The core portfolio allocations remain unchanged this week. They have a small hedge or 40% cash. The volatility hedged portfolio is still 100% long.

Leave A Comment