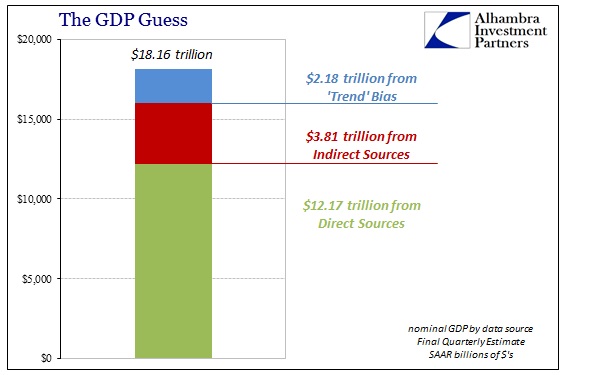

The “final” estimate for Q4 GDP was uninteresting save the update to corporate profits and cash flow. The upward revision to 1.4% wasn’t really any different than the preliminary or advance estimates, and since 12% of it was simply a guess by the BEA it doesn’t amount to a whole lot of solid analysis especially when in conflict with so many other accounts. I would argue that the only method keeping GDP positive is its increasingly tenuous deference to that 12%.

While that results in 2015 average GDP almost exactly matching the disappointment of 2014 (the averages calculate out to 2.428% for 2014 and 2.426% for 2015), it would only take an overstatement in the “trend” component of $60 billion out of the $2.2 trillion to turn GDP negative for Q4. All that, however, is just splitting hairs in trying to determine the exact slope of what increasingly looks like at the very least structural reversion. While that much has become quite apparent in especially consumer spending indications, it is at least as much on the corporate side if not more so.

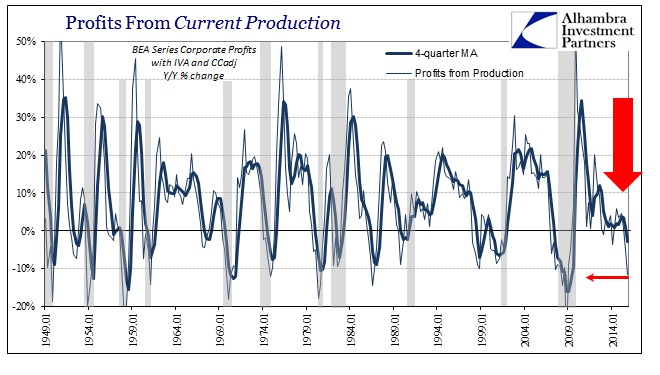

The updates for corporate profits and cash flow were just that kind of alarming in their declines. Thus, once again we see the mix of structural change matched with the sort of cyclicality that suggests recession combined with negative trend or potential. Profits from current production (the GDP equivalent of operating earnings; Corporate Profits with Inventory Valuation Adjustment and Capital Consumption Adjustment) dropped by 11.5% in Q4. That decline follows the rather large 5.1% contraction in Q3, and was the largest by far since Q3 2008. The 4-quarter average is now negative (at -2.9%) for the first time since the Great Recession ended.

There is only one “false positive” when profits decline by such a large amount, the near recession in 1986-87, though the mess after the Asian flu and during the worst of the dot-com bubble might qualify. In any case, hugely negative profit growth is far more recession warning than not. That point is affirmed by corporate cash flow, which also declined by a large proportion. At -10%, it wasn’t the largest contraction in the cycle, merely continuing the highly unusual and volatile economic pattern dating back to the events in 2011.

Leave A Comment