The theme for Single Country ETFs over the last month is either countries that produce a lot of natural resources (commodities) or countries in which sane people don’t invest. Okay, maybe sanity isn’t the proper metric but surely investors who can’t afford to take a loss shouldn’t be investing in Russia, Peru or Turkey, all three of which make the top 10 for performance over the last 3 and 1 month periods. For the one month period, just for kicks, Greece makes the top 10, another place the typical retiree probably ought not be chasing yield or returns.

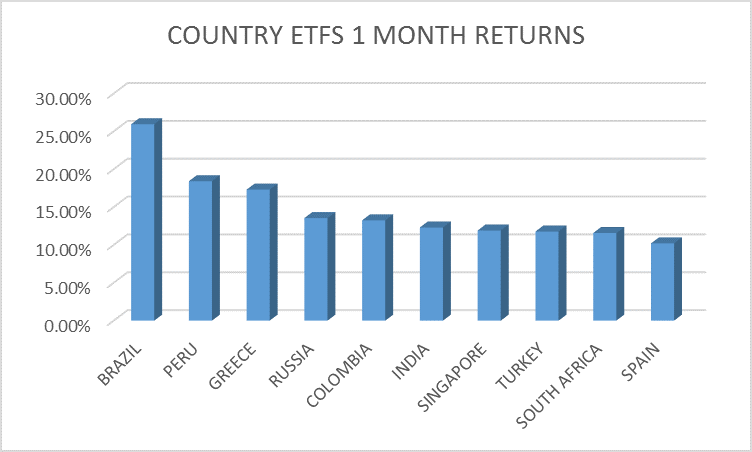

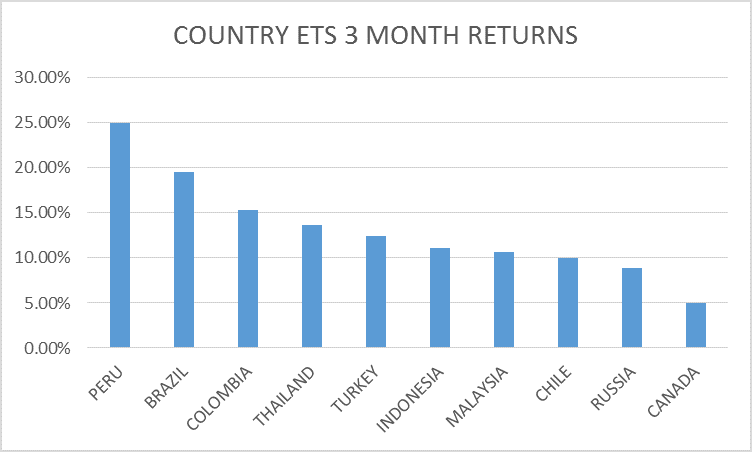

To be serious though, the performance of these Country ETFs proves one thing for sure – risk is not a static thing. Any market can become sufficiently cheap that investing in it can be a low risk endeavor. And some of these country’s stock markets were very cheap before these rallies and even more importantly, some of them still are. Here’s the return rankings:

This is part of the weak dollar/strong commodity/higher inflation expectations theme I’ve been writing about the last couple of months. As the dollar has softened, commodity prices have risen and stock markets in countries that are heavy commodity producers have risen dramatically, an indication that the sentiment had moved way too far in the other direction. Almost no one was expecting a commodity rally with the global economy – especially China – so weak. But a weak dollar is powerful stuff even if it isn’t fully realized.

I think this rally has actually moved a little too far, too fast. Commodities and stock markets in countries where they are produced are due for a rest and the hawkish jawboning of the Fed last week started to take the froth off a bit. Based on the frequency and timing of the Fed’s passive/aggressive hawk/dove act one could be excused for thinking maybe the object of their obsession is the stock market rather than real economy factors. But I digress and so does James Bullard. It may seem as if the central banks have control, that the dollar is trading in a range that is acceptable to all…something that happens only very rarely and surely won’t last.

Leave A Comment