Why Technical Developments Shouldn’t be Ignored

This is a little addendum to our recent comments on the crude oil market (which you can see here, here and here, in chronological order). Apparently Goldman Sachs just published a research report calling for $20 oil – which strikes us as a bookend to their infamous $200 call in 2008, which preceded the ultimate peak at $149 by just one or two weeks if memory serves (readers may remember this call by GS – it did get a lot of press at the time).

Photo credit: fmh

The recent sharp reversal after a seeming break of support definitely deserves attention, especially as everybody seems certain that after having declined some 75% from its peak, the price of oil can only go down further. Obviously, no such certainties were in evidence anywhere near the peak or when WTI crude was still trading near $100 a year ago (even though the supply-demand situation had quite obviously deteriorated gravely already).

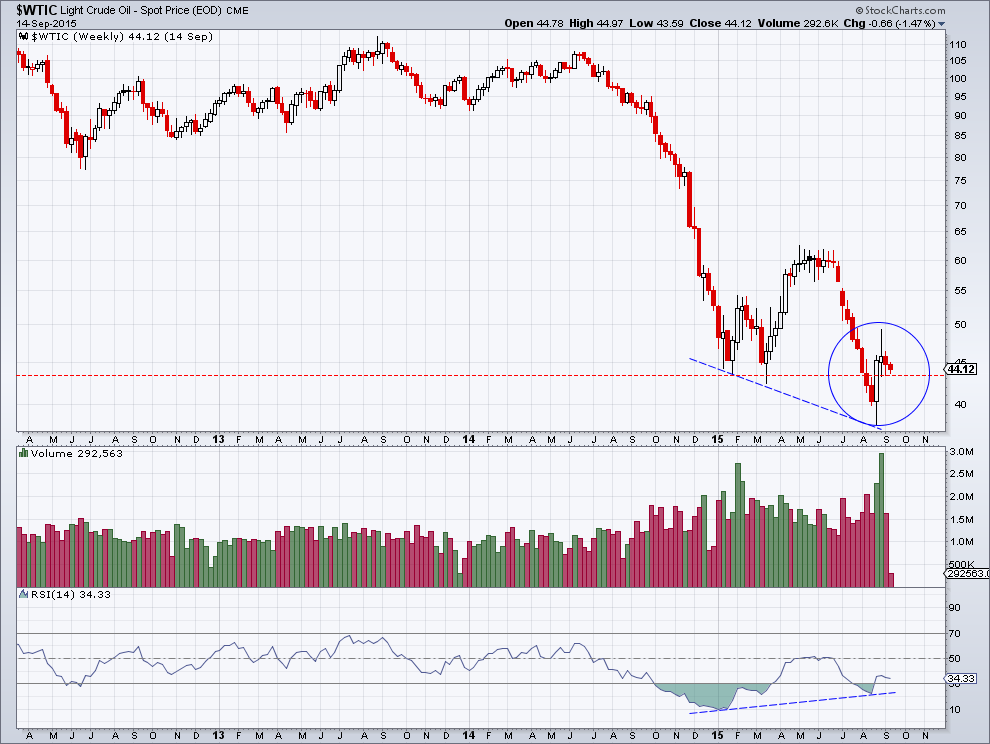

WTIC crude, weekly – a lateral support level was broken amid a price/RSI divergence, and then prices reversed back up. There hasn’t been any follow-through buying since then, so this reversal may yet fail, but it seems to us that the market is ripe for an upward correction even if the longer term bear market isn’t over yet – click to enlarge.

Anyway, we wanted to briefly come back to the reasons why we think such technical signals shouldn’t be ignored. For one thing, experience shows that price lows are put in long before the “fundamentals” indicate they should. In fact, price lows are routinely put in while the fundamental backdrop is seemingly still at its very worst. This is so because market prices are discounting negative fundamentals in advance to some extent; so even though the fundamental backdrop may still get worse, it offers no guarantee that prices will go even lower.

For another thing, nominal commodity prices are not only a function of the supply-demand fundamentals of the commodity concerned – they also reflect the amount of the money in the economy. If that were not so, crude oil might as well go back to $1,20, where it traded in the late 1960s/ early 1970s. In late 1998, crude oil traded at roughly $10 (then an 18 year low). Since then, the US money supply has roughly quadrupled.

Leave A Comment