It is time for a market observation post on crude oil. I simplified my analysis approach to quickly understand current market structures for potential trades.

The thing is, there is a professional way to analyze the market with volume profiles, acceptance/rejection areas, high/low volume areas, TPO (time) profiles and VWAPs including the comprehension of various profile shapes and the concept of value and distribution areas etc. As you can see it is pretty complex but after a while you will get into it step by step like with any other new skill or tool. In the end you will be able to see all these things in a plain chart.

The other way would be to analyze the market with plain charts and determine whether the market is balanced or imbalanced on various time frames, starting from the weekly chart in my case. On the way to the lower time frames we can then identify support/resistance levels and potential liquidity areas.The next important aspect would the timing of the trade execution after we identified a potential trade area. Actually, that’s it, roughly.

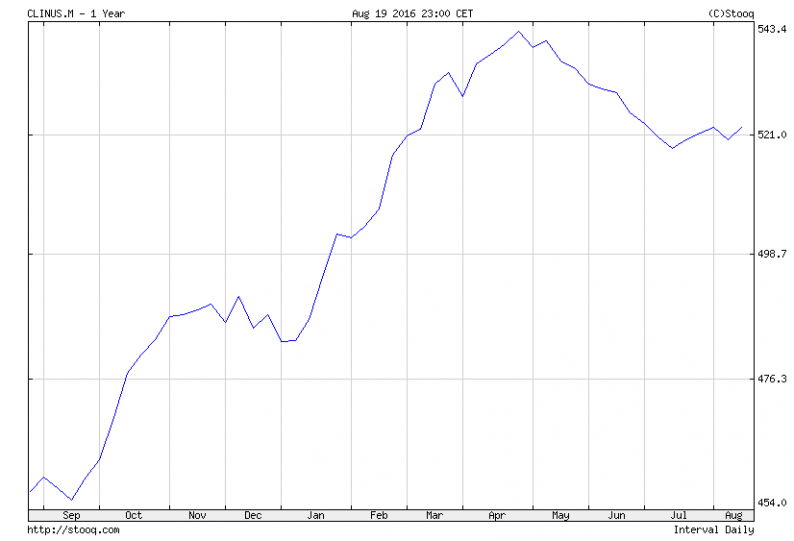

Before we dig into the charts, let us take a look at some fundamentals. Firstly, looking at the Crude oil inventories report we can see that the U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.5 million barrels from the previous week with a forecast of a decrease by 0.5 million barrels. The market reacted on that day with a sell off. Last but not least, at 523.6 million barrels, U.S. crude oil inventories are still at historically high levels for this time of year which you can see on this chart:

The next thing is to take look at the Commitments of Traders (COT) report in order to get a grasp what the managed money sector is doing. Looking at this Options and Futures Combined Positions (NYMEX + ICE) report, we can see that money managers were net buying 88.924 contracts of WTI crude oil in the week ended August 23. The number includes a huge short covering with 68.867 contracts. Interesting, as we had some huge short covering in the previous week as well.

Leave A Comment