The “short energy” trade worked great for a while and then, as we first warned in late January, just as everyone jumped onboard leading to record WTI (and oil and gas equity) shorts, it very suddenly stopped working in early February when oil proceeded to soar by 50% in the month ahead, leading to the biggest short squeeze on record and crushing all those who had recently gotten on the short bandwagon (as well as most other shorts).

The result of this mega-squeeze has been a significant revulsion to shorting oil directly or indirectly, either by way of the underlying commodity or energy stocks, many of which have soared in tandem.

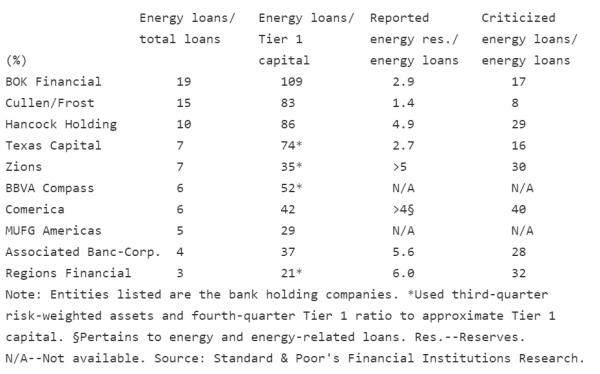

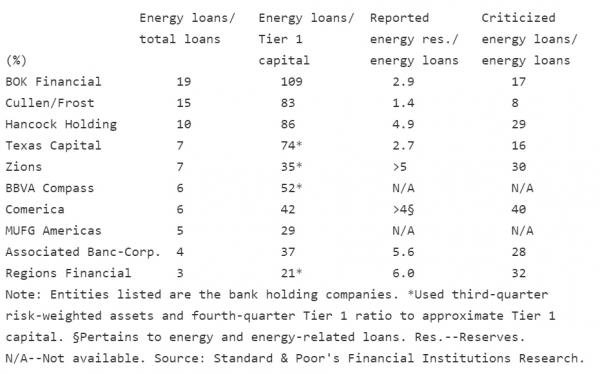

And yet the shorts remain, and continue to press their bets on the troubled energy sector. However, instead of directly shorting crude and various first-derivative oil and gas companies, short sellers – burned by the recent squeeze – have changed their strategy and shifted their sights to secondary exposure, namely those regional banks that do business with the industry. These are the same banks which, as we laid out previously, have the highest exposure to the very troubled energy sector, as laid out either by S&P:

… Or Raymond James:

It is these regional banks that Bloomberg finds are the object of shorts’ latest affection, as bearish bets have shot up 35% on average this year among the 10 most-shorted stocks in the KBW Regional Banking Index, and nowhere more so than at Cullen/Frost Bankers Inc. and Prosperity Bancshares Inc. in Texas, which have seen short interest surge about 60 percent.

The reason why shorts’ attention has been redirected to energy banks is well-known to our readers as we have been covering the banks’ exposure to energy since January: “as oil prices plunged, concern over energy companies’ ability to pay back loans drove investors to unload or bet against financial stocks judged to have the most at stake in the sector. So far, the rebound that pushed oil to around $40 a barrel has done little to dilute that speculation. Stubbornly low interest rates are also squeezing profits in a group that trades at a premium of almost 40 percent to their larger brethren.”

Leave A Comment