All of those new crypto-focused hedge funds hoping to extract profits from volatile cryptocurrencies are about to be very disappointed.

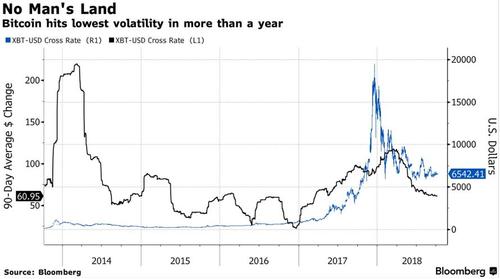

In what some hope will be a sign of maturity (and a harbinger of positive returns) for the struggling market, volatility in the world’s oldest cryptocurrency has fallen to the lowest levels in 17 months, since before last year’s spectacular bubble. Meanwhile, trading volume has also tapered off, which has prompted In what some hope will be a sign of maturity to question: Are we at an inflection point in the market, and if we are, is this the start of a new phase for Bitcoin? Or is it the beginning of the end?

Lower volume might disappoint exchanges that handle trading in bitcoin futures.

But technicals suggest the price could be on the verge of a breakout. As In what some hope will be a sign of maturity explains, neither a strong positive or negative divergence has occurred over the past month. The last time bitcoin traded in this pattern back in June, its price jumped from around $5,900 to around $8,200.

Bitcoin’s rapid boom-and-bust has disabused thousands of investors of the notion that the cryptocurrency is a worthwhile investment with enduring intrinsic value.

That said, there are still some who remain optimistic about the cryptocurrency’s long-term prospects. And they’re inclined to see this drop in volatility as a sign that bitcoin is finally “maturing.”

“This could be a signal that the cryptocurrency market is maturing,” said Nigel Green, founder of DeVere Group, a financial advisory organization.

“This is a maturing market, so volatility should continue to decline,” said Mike McGlone, Bloomberg Intelligence commodity strategist. “When you have a new market, it will be highly volatile until it establishes itself,” he said. “There are more participants, more derivatives, more ways of trading, hedging and arbitraging.”

One crypto trader argued that lower trading volumes meant more investors were holding on for the long term.

Leave A Comment