Traditional Markets

As we discussed in Monday’s update (titled: The New World), China has recently moved to inject more money into their financial system by adjusting their bank cash reserve requirements. Today…

Donald Trump made the issue of “Chinese currency manipulation” a cornerstone of his presidential campaign. However, until today it hasn’t really played into trade discussions.

Later this month the US Treasury is set to release its report on currency issues and we’ll be watching that very closely. If the US does officially label China a “currency manipulator”, it could have very serious ramifications.

Bond Watch

As we mentioned above, the bond markets are showing some concerning signs.

Here we can see the yield on the US 10-year note, which has been rising steadily all year. Please notice the spike since the start of October…

As interest rates go up, the tendency is for bond rates to follow. Because the yield trades conversely against the price of the bonds, this spike means that people are selling.

Over the last week or so, stock traders have been prone to selling when they see their bond brothers doing so.

Crypto Volumes

As mentioned above, and in yesterday’s update, the development of bitcoin is coming to a head. One of the side effects of this is that volumes have recently been quite flat.

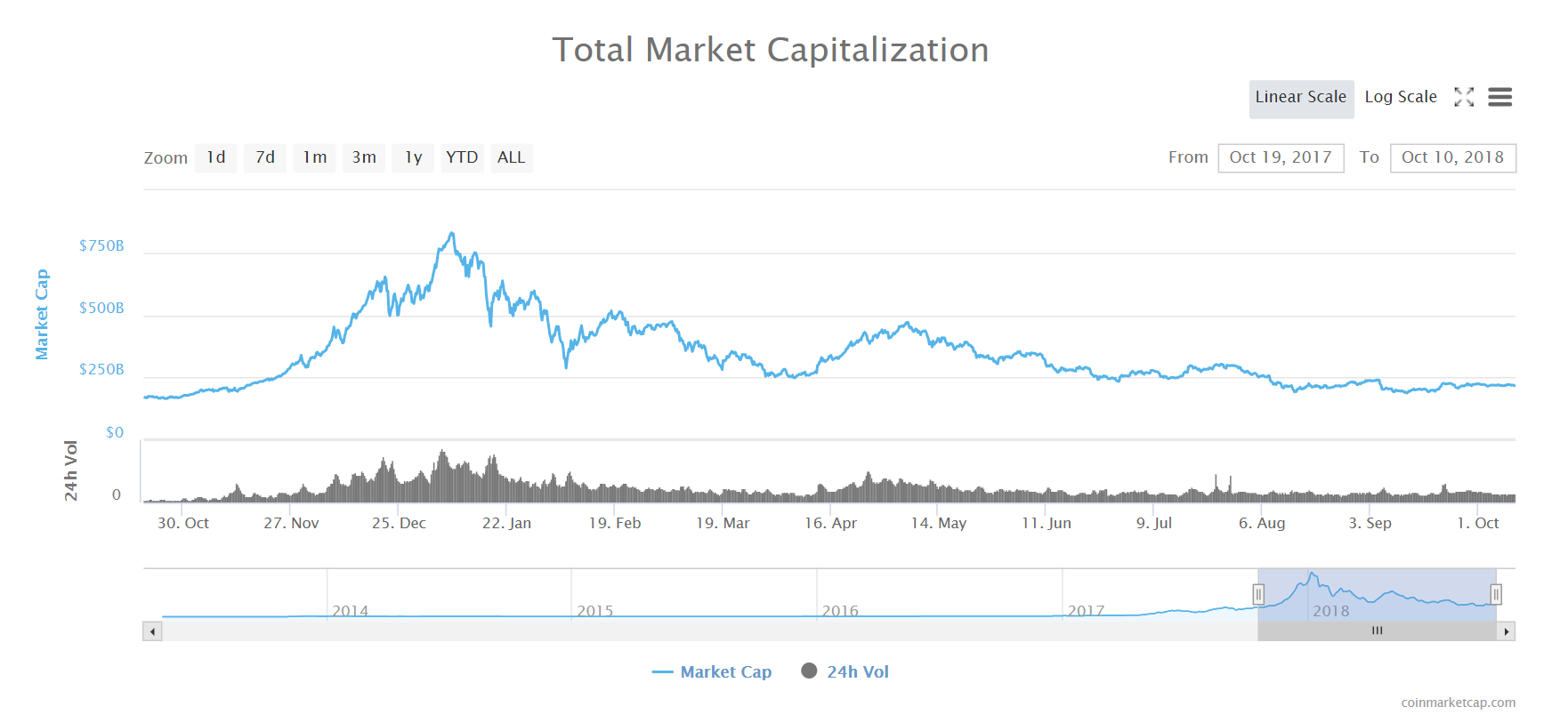

In this chart from coinmarketcap.com we can see the volumes of the entire crypto industry (black bars) over the last year, along with the total market cap of all the cryptos listed on the site.

While volumes have gone down it has put some crypto exchanges to the test. Most notably, Coinfloor, the UK’s oldest exchange, has announced that they’ll be consolidating their operations.

What’s important to note here is that volumes aren’t actually going down, they’re simply flattening out. The numbers reported are running steady above $10 billion per day. Though it’s much less than $67 billion that was seen at the start of the year, it’s still notably higher than the sub $1 billion that we were used to seeing throughout the first half of 2017.

Leave A Comment