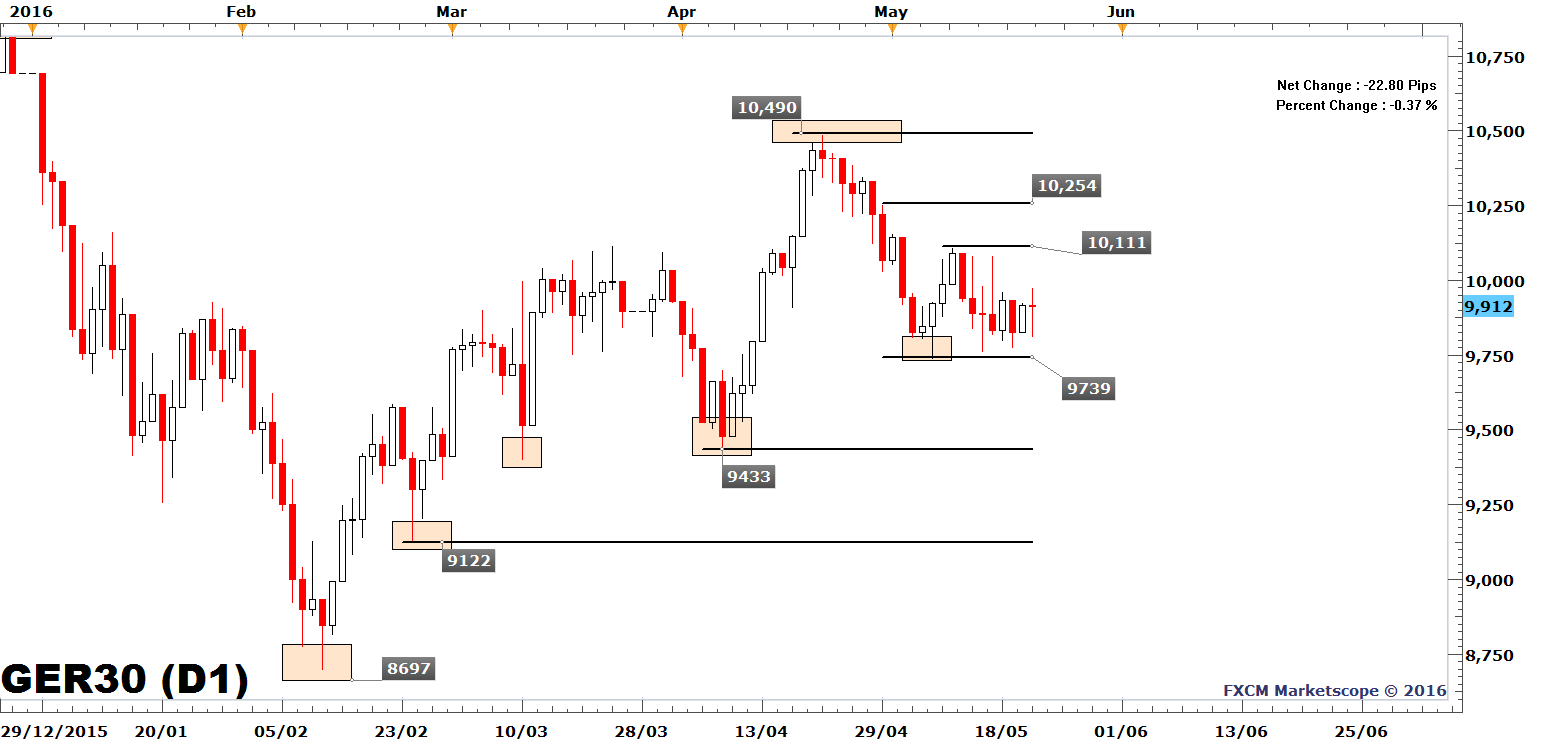

The DAX 30 kept on seesawing this morning and price was firmly stuck between the May 6 low of 9739 and the May 10 high of 10,111. Short-term bursts of momentum between these levels have been hard to predict and until a break to the above-mentioned range occurs, it is likely that price will continue to oscillate with no clear bias.

Support levels below the May 6 low of 9739 are the April 12 low of 9617, the April 11 low of 9528 and the April 7 low of 9447. Resistance levels above the May 10 high of 10,111 are the May 2 high of 10,154, the April 29 high of 10,254 and the April 28 high of 10,333.

DAX 30 | CFD: GER30

The Markit German Composite PMI rose to 54.7 from 53.6, and thereby beat the 53.9 expected as per a Bloomberg News poll. The gain seen today is the first rise of 2016. The German DAX did not react following the release of this report and instead, the price rose following disclosure of the Markit Eurozone Composite for May.

Contrariwise, the outcome of the Eurozone Composite was soft as the index declined to 52.9 from 53, which is a softer reading than the 53.2 expected as per a Bloomberg Survey. Markit, the complier of the report, says that the lower PMI composite over the last two months suggests a slowing Eurozone GDP in the second quarter. They also highlight that new business growth slid to its lowest level since January 2015, which points towards soft growth in June. As the dust settled and following two hours of trading, the DAX 30 returned to levels seen prior to the publication of the Eurozone Composite.

Leave A Comment