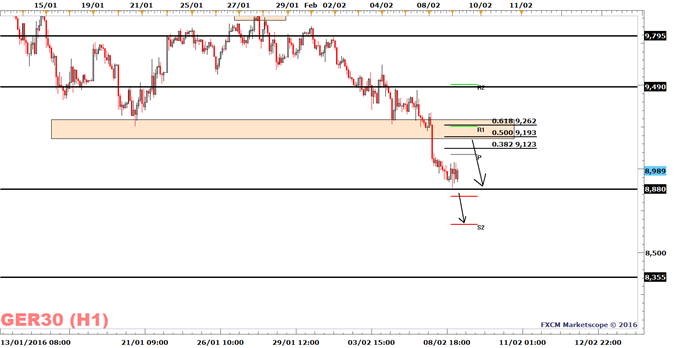

The German DAX 30 (DAX) is short-term oversold this morning and looks ready for a bounce. However, with the overall trend being bearish below Friday’s high of 9490, most traders will see a correction to yesterday’s breakdown level of 9260 as an opportunity to add to their bearish exposure. The alternative scenario is a break to yesterday’s low of 8880, which would open the door for a decline to today’s Support 2 level (S2) of the Pivot Point indicator. True support is first found at the November 16 low of 8355, hence the current downward trend may yet have further to run.

E.U. GDP Looks To Slow

German Industrial production declined by 2.2% YoY in December from positive growth in November, missing expectations of a decline to -0.6%. This suggests that E.U. GDP may have dropped to 0.63% YoY from1.6% YoY in the third quarter and may also partly explain the current softness in the DAX 30. Yesterday, the Sentix index for Europe softened from 7.4 to 6, suggesting that economic activity is unlikely to pick up any time soon. This may weigh on the DAX going forward.

Today, U.S. NFIB Small Business Optimism, Wholesale Inventories and JOLTS Job openings are on deck. See all data on our economic calendar.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment