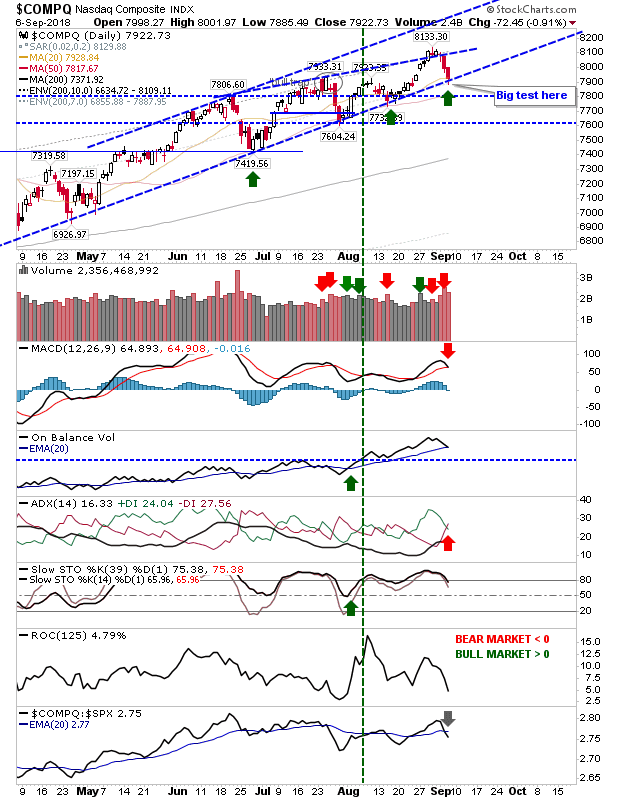

The Nasdaq experienced its second day of losses to bring it back down to 2018 channel support. This looks to be a critical time for the index given the convergence with the 20-day MA. There was a MACD trigger ‘sell’ and -DI/+DI ‘sell’ too to compound today’s selling. On-Balance-Volume will turn negative tomorrow if there is another down day.

From a trade perspective, buying support would look to be the favored option but given this has come from a failed upside break from the wedge (inside the larger channel) the likelihood for a break lower and a move to test the 200-day MA would perhaps be favored. Where longs will edge it is if there is a gap lower but a subsequent move back inside the channel.

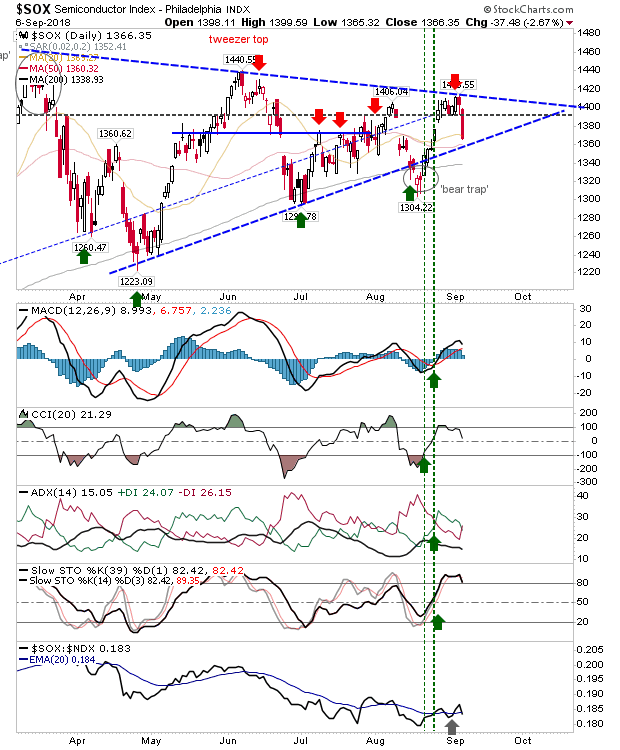

Semiconductors took the biggest hit. The ‘bear trap’ should have brought an upside breakout but this didn’t happen. Now the index is accelerating towards support and if this breaks then there isn’t a whole lot of support to lean on until you get to 1,240ish. If there is a break it will hurt the Nasdaq and Nasdaq 100 too.

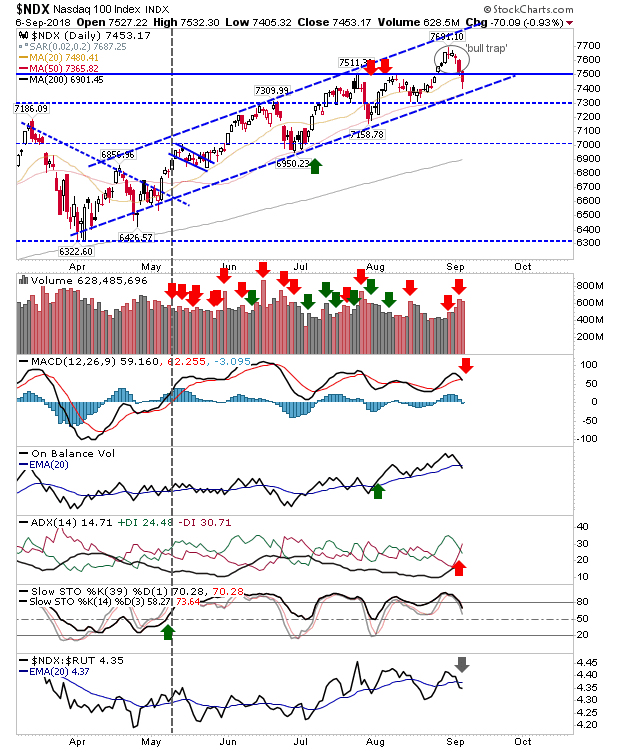

The Nasdaq 100 hasn’t quite made it back to channel support but it did leave behind a ‘bull trap’.

Large Caps are mixed. The S&P left a clear ‘bull trap’ and is on course to test channel support. The 20-day MA has offered a temporary stall but it may have come a little early. There is a ‘sell’ trigger in the MACD and On-Balance-Volume in support of a bearish setup.

Meanwhile, the Dow Jones Industrial Average has done enough to hold support and may yet kick on higher. Best is the relative performance which started a bullish reversal back in July and continues to improve. There is a MACD ‘sell’ but On-Balance-Volume building towards a break to new 6-month highs.

The Russell 2000 continues to make its way back to 1,705 support. This could see a test tomorrow although the index finished the day at its 20-day MA and there may be enough to see a bounce. As with other indices, there was a MACD trigger ‘sell’ but the technical weakness is not a big concern here.

Leave A Comment